When done right, a pass-the-fee program is one of the most straightforward, high-impact ways for dealerships to protect their margins. But success isn’t just about flipping a switch – it’s about launching with confidence, compliance, and clarity. From legal obligations to staff preparation, this is your go-to checklist for rolling out a compliant, customer-friendly solution.

At Rescue Payments, we guide dealerships through every stage of this process – from compliance setup to staff training and signage. This checklist outlines the key steps we help you cover to ensure a smooth rollout.

Step 1: Confirm Approval and Finalize Internal Prep (Start with Fixed Ops)

Why it matters: With card network registration and processor setup already handled by your provider, your first step is ensuring internal alignment. Dealership leadership should validate that all systems, signage, and staff messaging are ready for a smooth rollout. Start with fixed operations – specifically parts, service, and internal recon – where transactions are frequent, average ticket sizes are lower, and customers are already accustomed to using debit. This creates a low-friction environment for introducing the program before expanding to vehicle sales.

Checklist:

- Audit department readiness: tech, training, and terminal configuration

- Begin pilot phase in Fixed Ops before expanding

Leadership POV:

“Are we truly ready to flip the switch? Let’s do a final walkthrough of tools, messaging, and tech across departments.”

Step 2: Review Fee Display and Terminal Settings

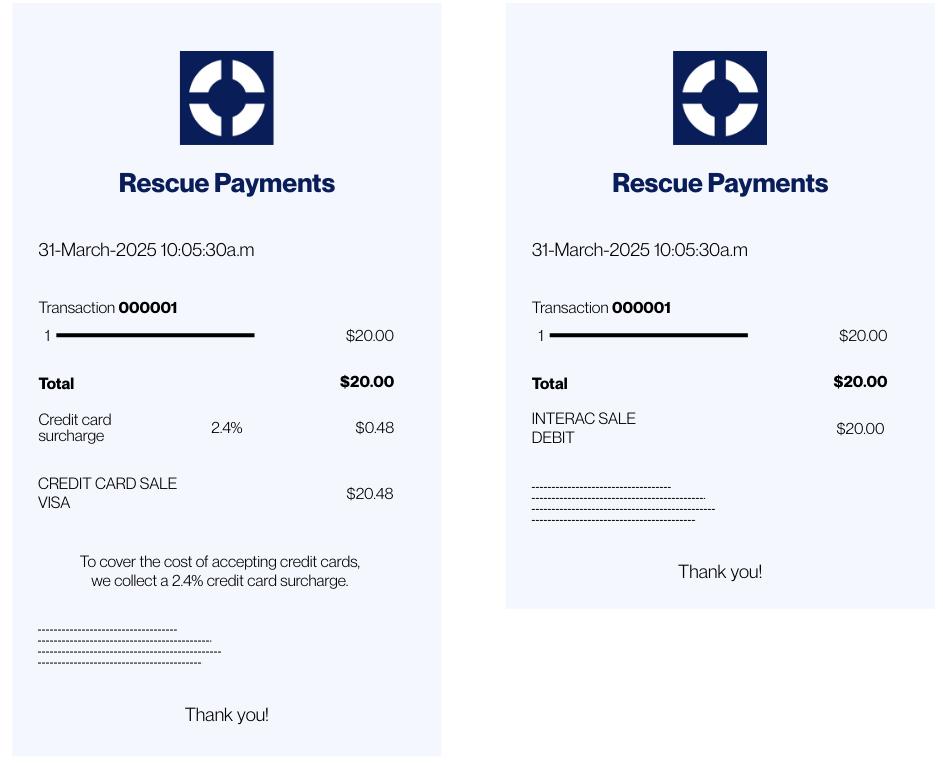

Why it matters: While your processor ensures the correct rate and card logic are applied, it’s essential that your dealership confirms how the fee appears to the customer. This includes double-checking receipts, display prompts, and terminal language to ensure consistency with training and signage.

Checklist:

- Test the customer checkout flow at each terminal

- Ensure the surcharge appears clearly on-screen and on receipts

- Confirm debit and cash options remain fee-free

- Align display language with your customer-facing signage and scripts

Leadership POV:

“How does the fee appear from the customer’s point of view? Let’s test it end-to-end and make sure the visual language matches our signage.”

Step 3: Update Signage and Customer-Facing Messaging

Why it matters: Transparency is a non-negotiable requirement for compliance. Clear signage at the point of entry and point of sale is required by all card brands, and helps set expectations early. The tone and clarity of your signage can make or break customer perception.

Checklist:

- Post signage at public entrance and payment stations

- Ensure signage matches your exact surcharge rate and terminology

- Include language that highlights debit/cash as fee-free alternatives

- Review with staff to ensure everyone understands what the signage communicates

Leadership POV:

“Are we being transparent enough that a customer wouldn’t feel caught off guard? Let’s test our signage on someone outside the team.”

Step 4: Train Staff and Align Customer Scripts (Protect CSI Through Messaging)

Why it matters: Your frontline staff are your first defence against confusion or frustration. Well-trained staff can turn a pass-the-fee conversation into a value-add, especially when it’s framed around customer choice and fairness. CSI scores are directly impacted by how fees are presented, so scripting should emphasize that the fee goes to the processor, not the dealer, and that debit and cash remain fee-free options.

Checklist:

- Provide sample scripts and answers to common customer questions

- Messaging: this fee does not go to the dealership

- Encourage staff to use language around customer choice, and transparency

- Role-play challenging scenarios in advance

Leadership POV:

“Do our staff feel confident explaining the program, and do they understand the financial upside for the business? Let’s ensure they can speak to it without friction.”

Step 5: Monitor, Review, and Optimize

Why it matters: A successful launch is only the beginning. Monitoring allows you to catch any compliance gaps, gauge customer reactions, and iterate on your internal processes to improve outcomes.

Checklist:

- Review schedule: Day 1, Day 30, Day 60, Day 90

- Track customer feedback

- Evaluate reporting: margin saved, fee coverage

- Revisit staff scripting and signage based on real-world usage

Leadership POV:

“How is the pass-the-fee program performing after 30, 60, 90 days? Are there friction points we can smooth out or wins we can build on?”

Final Validation: Before You Go Live

Once you’ve completed the checklist above, it’s worth pausing for a final review – just like you would before a major sales event or seasonal promo.

Final Readiness Questions:

- Is your signage visible and accurate at the entry point?

- Have you tested your terminals with real transactions?

- Do all managers and front-line staff feel equipped to explain the program?

- Have you reviewed receipts and signage for compliance?

Rescue Payments clients receive a launch readiness walkthrough to help cover every detail, because compliance is only part of the picture. Confidence is the rest.

The Bottom Line

Launching a compliant pass-the-fee program isn’t just a tactical move – it’s a strategic one. Dealerships that take the time to implement it properly reduce their processing costs, avoid compliance risk, and strengthen trust through transparency and preparation.

Use this guide as both your internal launch plan and your customer-facing action checklist. And if you want expert support at every step – from signage to scripting to staff training – Rescue Payments is here to help.