We went through our email and call logs to find the most common questions people have about surcharge programs in Canada. This is a comprehensive list of the most common questions we get about surcharge pricing. It includes some of the basics as well as the more nuanced questions that might come up as you consider a surcharge program.

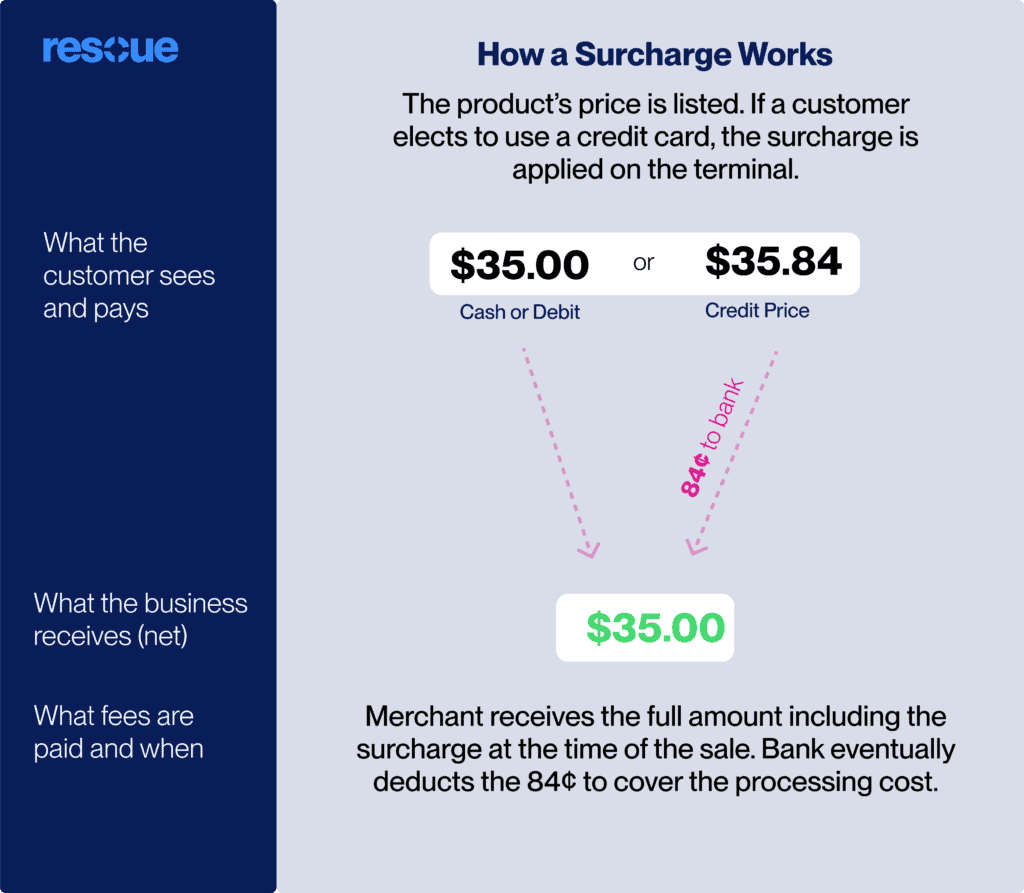

Here is How a Surcharge Works

Frequently Asked Questions

- “Are there legal requirements for implementing a credit card surcharge program?”

There are! We have a helpful guide that you can explore here, but generally you need to provide clear disclosure to customers at the point of entry, point of sale and on the payment receipt itself. There are also limits on the surcharge percentage. - “How does the rise of mobile payments and digital wallets affect surcharge strategies?” Digital wallets (think Apple Pay & Samsung Pay) are still using traditional credit/debit cards, so standard card brand surcharge rules would apply. But customer acceptance and disclosure methods may evolve with these newer payment methods.

- “How can I clearly communicate surcharges to my customers to maintain transparency?”

Transparency is key – clearly disclose the surcharge amount or percentage on receipts, websites, and signage. Often our merchants frame it as passing along costs and keeping costs low. - “What percentage of a surcharge can I legally apply to credit card transactions?”

In Canada the surcharge amount is 2.4% - “How do surcharges affect customer behavior and satisfaction?”

Our merchants report that a vast majority of customers will not mind if clearly disclosed and if they do not wish to pay the fee the elect to use another form of payment like debit or cash. - “How do surcharges impact employee compensation programs like commission/incentives?“

Employee compensation tied to net revenue can be positively be impacted by the introduction of a surcharge program. Compensation plans can increase if costs go down. - “How can surcharging be leveraged as part of an overall payment optimization strategy?”

Surcharging can be one component of a larger payment optimization approach that also looks at negotiating better processor rates, incentivizing non-credit payments, card-level coding, and automated billing tools - “How can a strong surcharge policy and program impact business valuation?” A well-designed, compliant surcharge program that generates significant revenue & offsets costs can positively impact profitability metrics and valuation multiples for a business.

- “Can implementing surcharges help lower my overall credit card processing fees?“

Absolutely! Passing processing fees to customers who opt for credit can significantly lower your net costs on those transactions, typically to near zero. - “How can AI and machine learning assist in optimizing a surcharge program?”

AI/ML could potentially analyze sales data, market trends, customer segments and behaviors to predict ideal surcharge rates, timing, and customer response – then help automate adjustments. - “What are the differences between a surcharge and a convenience fee?”

A surcharge is specifically for covering credit card fees, while a convenience fee is for offering an alternative payment channel like online or over the phone. You can not charge both. - “Are surcharges allowed on debit card transactions?”

The 2.40% credit card surcharge is not allowed on debit transactions in Canada. Interac does allow a fixed dollar amount surcharge to be applied to debit transactions. - “How do I set up a surcharge program that complies with my payment processor’s policies?”

Check with us for specific surcharging program requirements around registration, software, disclosures, etc. Need help? We can help guide compliance too. - “What signage or notifications do I need to display in-store and online about surcharging?”

Clear signage at entry points and checkout is required. Online, a notice during checkout helps disclose it properly. - “How can surcharging impact my business’s competitiveness in the market?”

Being able to keep pricing low is a competitive advantage. Our merchants report little to no complications from introducing surcharge. Proper communication to customers is key. - “What are the potential risks of losing customers due to surcharging?”

A small group of customers may see surcharges as a turn-off, so there’s a risk of losing business if not properly explained as covering your costs. Costs associated with any lost revenue are often drastically offset by lowering your cost of acceptance to zero. - “Can I apply surcharges to only certain types of transactions or cards?”

You are not allowed to surcharge by card type (you can’t discriminate between Visa and MasterCard), but in certain cases you can by product type. Reach out and we can help you determine the right path here. - “What are the specific regulations around surcharging in my province or locality?”

Surcharge and Dual Pricing is legal across Canada, with the exception of Quebec. - “How do I ensure my surcharge program is compliant with major credit card brand guidelines?”

Visa, Mastercard, etc. all publish operating rules you must follow around surcharge amounts, disclosure requirements, signage, and more. But don’t worry, all of that info comes in our Rescue Kit. - “What technology or software changes do I need to implement surcharges?”

This is where we can help. You may need a software update or new equipment to calculate, display and properly record the surcharge details. In other cases, we can overlay technology on your existing payment system and provide a compliant solution. - “How do I track the impact of surcharging on sales and customer retention?”

Track sales figures and customer counts before and after surcharging. Survey customers on their awareness and perception of it. The biggest change you will typically see is 30% switch to low-cost payment methods like debit or cash. Woohoo! - “Are there any industry-specific considerations I should be aware of when surcharging?”

No, however there are different MCC codes to be considered from an interchange perspective. - “How frequently can I adjust the surcharge rate?”

Most businesses set their surcharge rates at 2.4%, as this covers most of the cost of acceptance for most credit cards in Canada and ensures the least amount of cost to the business. - “What are the best practices for informing new and existing customers about surcharges?”

Email campaigns, updated pricing pages on your website, and signage at checkout areas are great ways to inform customers. We have some great guides and content to help this. - “How can I measure the effectiveness of a surcharge program?” The biggest thing you will notice is a drastic reduction in fees (typically 99.7%).

- “How do surcharges affect online transactions versus in-store purchases?” Online you have more flexibility to require acknowledgment before completing a purchase. In-store relies more on visible signage.

- “Can surcharges be applied to international credit card transactions?” Yes, surcharges would apply to any credit card transaction regardless of the card’s origin, as long as properly disclosed.

- “What are the tax implications of implementing a surcharge?” Surcharges are considered tax-exempt reimbursements for costs passed to the customer, not part of your taxable income. Read our full tax guide for surcharges here.

- “What alternatives to surcharging are available to offset credit card processing fees?”

Other options include offering cash discounts for non-credit payments, raising product prices slightly to absorb fees, or setting minimums for credit card transactions. However, surcharging is often the most direct way to defray costs. - “How does the customer’s credit card brand affect the surcharge?”

The card type does not affect the surcharge amount. - “Are there specific surcharge caps or limits set by provinces or credit card companies?”

Yes, the cap federally is 2.4% everywhere except Quebec, where it is not currently legal. - “How do I handle customer disputes related to surcharges?”

Have a clear returns/refund policy that states surcharges are refunded for returns. Provide training to staff so they can explain the policy and fees. - “Can I offer discounts for non-credit card payments instead of surcharging credit card payments?”

Yes, cash discounting or dual pricing is an alternative where you provide a percentage discount to customers paying via cash, check or debit instead of passing fees to credit card payers. NOTE: This method requires you to post credit card prices instead of cash prices. - “What impact do surcharges have on small transactions versus large transactions?”

For small-ticket purchases, surcharges are minimal so customers may not mind as much. But for higher transactions, the added surcharge fee may be more notable. However, with the prevalence of rewards cards, many customers are interested in paying for higher priced items to get the maximize points or cash back. - “How do I calculate the break-even point for implementing a surcharge program?”

Reach out for a rescue review and we can do this calculation for you! - What are the ethical considerations of implementing a surcharge?”

Most importantly, be fully transparent by clearly disclosing surcharge amounts and reasoning. Don’t try to hide or misrepresent the fees. - “Should surcharges be refunded in the case of returns or cancellations?”

Yes, if a customer returns an item or cancels a service, the portion of fees originally paid as a surcharge should be refunded back to them. - “How do I prepare my staff to explain surcharges to customers?”

The Rescue guide will provide you with resources that will help your staff with talking points on the surcharge program. The guide will also provide common rebuttals, as well as information on dealing with objections. Role-play scenarios and have managers clarify any staff confusion. - “What are the common customer objections to surcharges, and how can I address them?”

Objections to new programs is normal. We can help you have scripted responses that convey full transparency, discussions around passing along costs only, and offer no-fee payment alternatives like debit or cash. - “How does introducing a surcharge affect my contractual obligations with credit card processors?”

Rescue will review your merchant agreement and ensure you are meeting new compliance standards. We handle all of the contractual obligations. - “How do I balance the need for surcharges with maintaining a positive customer experience?”

Be upfront about the reasoning, disclose fully, and ensure staff are well-trained in explaining it positively. - “Are there any sectors or industries where surcharges are more commonly accepted?” We see a pretty wide diversity. Surcharges are common in industries with higher ticket transactions like automotive services, healthcare, education, etc. Customers may expect fees for bigger purchases. We also see a lot of low-ticket transactions like convenience stores, cigar shops and barbershops.

- “How do I conduct a cost-benefit analysis of implementing a surcharge?

Get a Rescue Review and we can give you a full analysis of the savings. Calculate your current annual processing costs, then estimate potential surcharge savings based on transaction volumes/values. Compare the net savings to implementation efforts. - “What are the long-term impacts of surcharging on customer loyalty?” When implemented well, communicated transparently with options offered, the impact will likely be minimal. Any lost customers are usually made up by the increase in net profit margin gained.

- “How do I monitor and adjust my surcharge policy based on market changes?

Rescue handles this for you. We review processing costs and rules/regulations to ensure you are in full compliance. - “What are the guidelines for surcharging in e-commerce settings?”

Online, you need clear disclosure on the checkout pages before purchase, grant the ability to cancel, and provide a proper receipt or invoice descriptors. We also recommend providing other fee-free options like Interact Debit or E-Transfer. Need help setting these up? Just ask. - “How can I leverage technology to streamline the surcharge process? This is critical and a big part of why Rescue is the choice for a lot of merchants. Our platform hooks into POS systems, e-commerce platforms, and payment gateways that automate and properly calculate surcharges . This reduces manual effort.

- “What impact do surcharges have on payment processing speed and efficiency? Surcharges themselves don’t impact processing speeds. Having a Rescue terminal that automatically calculates fees and compliantly provides receipts in essential.

- “How do surcharges impact a business’s pricing strategy?” Surcharges allow you to maintain lower sticker prices on products/services since processing fees are offset separately.

- “What are the implications of surcharging on accounting and financial reporting practices?”

Surcharge amounts should be recorded separately from sales/services revenue for proper reporting. Additionally, auditors may require documentation showing your program complies with card brand rules and federal laws. Our system breaks out the surcharge and allows you to easily reconcile and report surcharge values. - “How can a business use surcharging as a competitive differentiator?”

Many businesses today don’t accept credit cards due to the high cost. Stand out amongst your industry competitors by giving customers the option to pay with a credit card! - “Can surcharges be applied differently based on specific product categories or customer segments?” Generally, surcharges need to be applied equally and not used to divide customers unfairly. However, some businesses could potentially have product-specific surcharges if properly disclosed. Have a use case in mind? Ask us.

- “What security measures should be in place to protect customer payment data when surcharging?”

No new security measures are required, but you must still maintain PCI compliance by using secured payment terminals/gateways and following data protection best practices when surcharging. But don’t worry, we handle all of that for you. - “How can a business stay updated on changes to surcharge laws and regulations?” Rescue is your partner for compliance. We monitor the laws, consult with processors/partners, review card brand policy updates, and distribute updates to our customers whenever changes impact their programs.

- “What change management strategies are effective when rolling out a new surcharge program?”

Proper planning, documentation, training, , strong internal/external communications, monitoring feedback, and being willing to adjust your approach are all important change management steps. - “How do surcharges impact business growth and scalability in the long run?” Surcharging itself doesn’t directly impact growth potential. However, the cost savings and pricing advantages it provides could allow you to reinvest in areas that do foster further scalability.

- “How can a surcharge program be integrated with existing loyalty or rewards initiatives?” Surcharges are separate fees passed to the customer, so they shouldn’t directly impact how loyalty/rewards points or discounts are earned, which are typically based on the total transaction amount before surcharges.

- “Can surcharge rates vary based on different payment methods (e.g. credit vs. debit)?” Yes while you surcharge credit card transaction, you are not legally allowed to apply a percentage fee to debit card payments. However since debit card processing rates are significantly much lower, this offset is beneficial as customers move to debit.

- “What role can data analytics play in optimizing a surcharge strategy?”

Analytics on sales data, surcharge amounts, customer feedback, etc. can help identify issues, forecast impacts, pinpoint which surcharge rates are ideal for your business mix, and fine-tune your program. - “Are there any notable case studies or success stories around implementing surcharges?”

There are many examples of businesses that use Rescue, especially in sectors like healthcare, auto repair, and professional services, that have boosted profits and neutralized processing costs through smart surcharging programs. - “How do surcharge policies need to be adapted for businesses operating across multiple regions?”

If operating in various countries, you’ll need surcharge policies and tools that can accommodate the specific rules and caps for each region your business spans. - “What is the impact of surcharges on businesses operating in the cash-intensive industries?”

For cash-heavy businesses like restaurants, retail, etc., surcharges may have less impact since more transactions are done in cash/debit already. But it can still help offset costs on credit card payments received. - “How do surcharges affect businesses that operate on a subscription or recurring billing model?”

For subscription businesses, clearly disclosing any surcharges upfront is important so customers understand the full recurring charge. Policies should address prorating surcharges for mid-cycle payments. - “What are the insurance implications of implementing a surcharge program?”

From an insurance standpoint, surcharge programs don’t present unique risks. - “Can surcharges be used as a pricing strategy for product bundling or cross-selling?”

Generally, surcharges must be clearly tied to payment method rather than added fees. But they could potentially be incorporated into some bundled pricing models with proper disclosure in certain cases. - “What are the ethical considerations around surcharges for nonprofits or charitable organizations?”

Many nonprofits surcharge. However even for nonprofits, clearly disclosing any surcharges is important to maintain transparency and trust with donors. But surcharges can help reduce operating costs like any business. Many donors elect to cover the credit card fee to ensure the maximum amount of their donation goes where intended. - “How can businesses stay compliant with surcharge rules as they evolve over time?”

Work with Rescue! Staying updated on payment brand and regulatory rule changes is key and we have you covered. - “How do surcharges impact businesses operating primarily in the B2B space?”

For B2B companies, surcharging is a clear win because businesses understand the concept of passing along costs. However, policies still need to be clearly communicated in contracts/agreements. Not to mention many business owners enjoy the benefit of receiving rewards points personally when paying with corporate cards. - “Can surcharges create conflicts with corporate purchasing policies of business customers?”

Potentially yes, if corporate customers have strict policies against paying surcharges or fees beyond stated pricing. Communicating surcharge reasons and getting approvals in advance is important. - “How can surcharging be integrated into business management software systems?”

Rescue has you covered. Our software suite integrates into many of the biggest accounting, ERP and inventory systems, as well as many of the world’s largest online shopping carts. . Have an integration need? Rescue can help. - “What training is needed for customer-facing staff regarding surcharge policies?”

Front-line staff need training on explaining the policy positively, comparing to overall price increases, as well as training on handling objections, and knowing the reasons behind surcharges. - “How do surcharges need to be presented on receipts?”

Surcharges must be clearly delineated as separate line items on invoices/receipts, not bundled into product pricing. - “What role do payment gateways and processors play in surcharge enablement?”

Gateways and processors are critical for surcharge support – ensuring correct surcharge rates, building compliance flows, calculations, disclosures, reporting and settlement functions. Rescue’s extensive integration network enables this. - “What opportunities exist for surcharges to generate revenue beyond offsetting processing costs?” Surcharge cannot exceed the price of acceptance, so they are not a profit center.

- “How can businesses use surcharges as a competitive pricing strategy?”

By implementing surcharges, businesses can promote having lower base prices on products/services compared to competitors who bake processing fees into their pricing. This can provide a competitive advantage. - “What are the implications of surcharges for businesses operating internationally?”

For international businesses, surcharge rules, rates and requirements can vary significantly by country. Localized surcharge policies and technologies are needed, based on the location of the merchant. Our technology helps to manage the complexity. - “Can surcharge analytics provide insights into consumer payment preferences?”

Yes, by tracking surcharge transactions versus cash/debit payments, businesses can better understand current customer payment method preferences and how pricing/surcharges may influence that behavior. - “What are the data privacy and security considerations around surcharge data?“

Surcharge transaction data is subject to the same data privacy rules as other payment card information. Proper PCI DSS controls like encryption, access limitations, and data retention policies apply. Don’t worry, we handle that. - “Can surcharges open a business up to more consumer litigation risks?”

Proper disclosure and complying with all rules is important, therefore there should be no increased risk associated with the surcharges. - “How can businesses develop surcharge-friendly checkout flows and user experiences?”

Design checkout flows with clear surcharge callouts, ability to easily see total costs, toggle non-surcharged payments, and obtain customer confirmation before completing transactions. - “What role can industry associations and advisory groups play in surcharge guidance?”

Groups like merchant associations, advisory boards, legal consultants and companies like Rescue can help businesses stay updated on surcharge rules, best practices and advocacy efforts.