Rescue Payments understands the full risk picture, not just your processing fees.

When businesses think about payment processing, the conversation usually starts with fees. And that makes sense – for many businesses, payment processing represents one of their largest monthly operating expenses. But behind the scenes, there’s another important consideration: chargebacks.

These aren’t just occasional operational issues. They can be challenging, damaging your bottom line, interrupting cash flow, and in some cases, jeopardizing your ability to accept payments at all. Every business that accepts card payments needs to understand the risks behind every transaction.

At Rescue Payments, we help our clients reduce fees, but also prevent revenue loss by helping them secure their payment environment and reduce chargebacks. Here’s what you can actually do to protect your business.

The Real Cost of Insecurity

Fraud-related losses for Canadian businesses continue to rise each year. But beyond the theft itself, the consequences that follow are what often hurt the most.

A chargeback in Canada typically costs a business around $25 per incident – in some cases, that amount can rise to $100 or more once you factor in processor penalties, administrative time, and lost revenue. If your chargeback ratio exceeds 1%, you may be flagged as high risk – leading to rolling reserves, processing restrictions, or full termination of your account.

PCI-DSS non-compliance – failure to meet card network security standards – can result in recurring monthly fines and loss of processing privileges.

Processing fees are easy to calculate. Risk exposure isn’t – but it’s often far more expensive.

What Is a Chargeback, and Why Does It Happen?

A chargeback occurs when a cardholder contacts their bank or credit card company to dispute a charge. If the bank deems the dispute valid, they forcibly reverse the transaction – pulling the funds from your account and returning them to the cardholder.

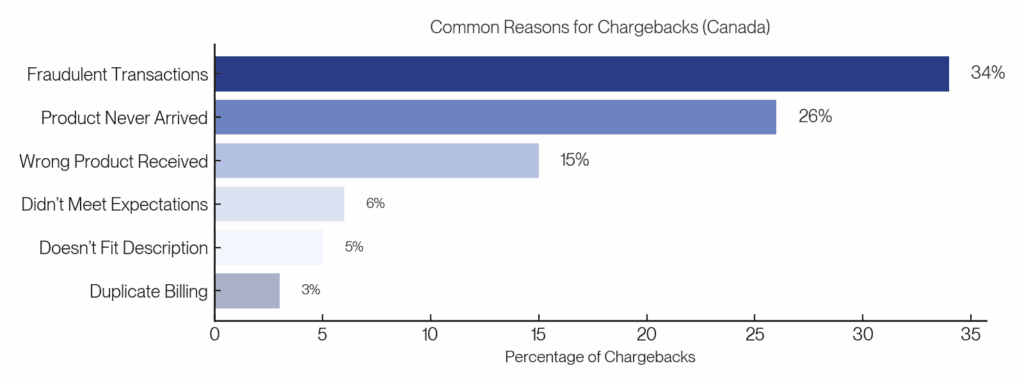

There are several reasons chargebacks occur:

- Fraudulent activity (the card was stolen or used without authorization)

- Customer disputes (they claim they didn’t receive the product or service)

- Unrecognized charges (the billing descriptor doesn’t match your business name)

- Billing errors (duplicate charges or incorrect amounts)

Some chargebacks are legitimate. Others are the result of misunderstandings. Regardless of intent, the merchant almost always bears the cost.

Chargebacks: How to Prevent Them and Win When You Need To

Chargebacks can’t always be avoided – but they can be reduced. Here are some effective ways to lower your chargeback risk:

1. Use clear billing descriptors: If your business name appears differently on a cardholder’s statement than it does online or in-store, they may not recognize the charge. We help ensure your billing name is aligned with your customer-facing brand.

2. Send confirmation emails and receipts: Immediately after a purchase, send a confirmation that outlines what was purchased, when, and from whom – including contact details for support. This step alone can deter many unnecessary disputes.

3. Make refund and cancellation policies visible: Set expectations early. Clear terms of service and refund policies reduce customer confusion and give you stronger documentation if a chargeback is filed.

4. Communicate with your customers: Sometimes chargebacks happen because customers feel ignored or frustrated. A simple response or refund offer can prevent the dispute from escalating to their card issuer.

5. Submit complete evidence when chargebacks occur: When chargebacks do happen, we help merchants submit compelling evidence: payment confirmations, screenshots of communication, proof of service or delivery, and customer correspondence – all with deadlines and formatting requirements in mind.

Fraud: The Front Line of Chargeback Prevention

While fraud detection is its own field, it plays a major role in reducing chargebacks – especially in card-not-present environments like online checkout or invoicing.

Tools like AVS (Address Verification), CVV checks, and geolocation filters don’t just stop fraud; they stop chargebacks before they start by blocking bad transactions at the source.

Friendly Fraud vs. True Fraud: Why It Matters

Not all chargebacks are created equal – and how you respond depends on what caused them.

- True fraud occurs when a stolen card is used without the cardholder’s knowledge. These chargebacks are rarely reversible – and the focus should be on preventing the transaction from happening in the first place.

- Friendly fraud, on the other hand, happens when a real customer files a chargeback they may not be entitled to. Whether they forgot the purchase, didn’t recognize the billing name, or decided not to request a refund, the end result is a dispute – one that you may be able to win.

Friendly fraud is fightable. With documentation (receipts, delivery confirmations, emails), many of these chargebacks can be overturned.

More Than Just Cost Savings

We built Rescue to make payment processing smarter, safer, and more sustainable for businesses. We don’t believe in charging extra for risk tools – because risk protection is the product.

With Rescue, you get:

- Built-in PCI compliance support

- Hosted payments

- Integrated fraud detection

- Chargeback dispute guidance

- Flexible pricing models like surcharge or Interchange+ to reduce processing costs

You don’t need a separate tool for every risk. You need one partner who helps you manage the full payment lifecycle – securely.

Bringing It All Together

Security, compliance, and risk management aren’t optional for modern businesses – they’re fundamental. The reality is that the cost of a breach, chargeback, or fraudulent transaction often outweighs your entire annual processing bill.

At Rescue Payments, we help businesses reduce those costs up front – and protect against the hidden risks that come with accepting cards in-store or online. Whether you’re just starting out or processing millions per year, your payment system should do more than move money. It should protect your customers, your cash flow, and your reputation.