Introduction

Welcome to the ever-evolving world of credit card processing, a critical aspect for any business in today’s digital-first economy. As a Canadian small or medium-sized business owner, understanding credit card processing fees is not just beneficial; it’s essential for your financial health and customer satisfaction. These fees, often seen as a necessary evil, can significantly impact your bottom line. They are complex, variable, and can be a source of confusion and frustration.

Enter Rescue Payments, a beacon of hope in the often murky waters of payment processing. We’re not just another payment processor; we’re revolutionizing the way merchants view and handle credit card transactions. Our innovative zero-fee processing solution is designed with you, the merchant, in mind. Imagine a world where accepting credit cards doesn’t eat into your profits. That’s the reality we’re offering.

Our approach is simple yet groundbreaking: by implementing our surcharge program, you can turn the tables on traditional processing fees. Instead of bearing the burden of transaction costs, you can pass them on as a small surcharge to the customer. This approach is fully compliant with Canadian regulations and is transparent to your customers. The result? Your business can enjoy the convenience of accepting credit cards without the financial strain of high processing fees.

Stay with us as we delve deeper into the intricacies of credit card processing fees and unveil how Rescue Payments can be the game-changer for your business.

What is a Credit Card Transaction Processing Fee?

At the heart of every swipe, tap, or online checkout involving a credit card, lies a not-so-hidden player: the credit card processing fee. This fee, though often overlooked, is a pivotal part of every transaction involving credit cards. But what exactly comprises this fee, and why does it matter to your business?

Understanding the Components

A credit card processing fee is not a single charge but a combination of several costs. These include:

- Interchange Fees: Set by the card networks (like Visa or MasterCard), these fees are paid to the card issuer (the bank that issued the customer’s credit card). They vary based on numerous factors, including the type of card used (credit or debit), the type of transaction (in-person or online), and the risk level associated with the transaction.

- Assessment Fees: These are additional fees charged by the card networks. They are usually a small percentage of the transaction value and are set by the networks to cover various costs related to electronic payment processing.

- Processor Rates: This is where we, as your payment processor, come in. Processor rates are the fees charged by companies like Rescue Payments for handling the transaction. They cover the cost of maintaining secure and efficient processing systems, customer support, and other services essential for smooth payment processing.

The Role of Card Networks, Credit Card Companies and Issuers

Card networks and issuers play a critical role in determining these fees. They set the rules and rates for interchange and assessment fees, ensuring that transactions are processed securely and efficiently. These fees are part of the complex ecosystem of digital payments, balancing the needs of various stakeholders, including merchants, customers, banks, and processors.

While it might seem like just another cost of doing business, understanding these fees is crucial for any merchant. They impact your pricing, profitability, and the payment options you can offer your customers. As a small or medium-sized business in Canada, navigating these fees intelligently can be the difference between just surviving and thriving in a competitive market.

In the following sections, we’ll explore how these fees are calculated and, more importantly, how Rescue Payments’ innovative solutions can help you manage and even offset these costs.

How Are Small Business Credit Card Payment Processing Fees Calculated In Canada?

Understanding the intricacies of credit card processing fees is akin to unravelling a financial puzzle. Each piece – from the type of card used to the specifics of a transaction – plays a vital role in shaping the final fee. For Canadian small and medium-sized businesses, grasping these nuances is not just about numbers; it’s about making informed decisions that can positively impact your bottom line.

Influencing Factors in Fee Calculation

Several key factors influence how much you’ll be charged for each credit card transaction:

- Type of Card: Credit cards come in various forms – standard, rewards, corporate, and more. Generally, the more benefits a card offers to the cardholder, like rewards or cash back, the higher the interchange fee tends to be. Debit cards, on the other hand, usually incur lower fees due to their different risk and rewards structures.

- Type of Transaction: How a transaction is processed also matters. In-person transactions (where the card is physically swiped, inserted, or tapped) typically have lower fees compared to online or keyed-in transactions. This difference is largely due to the varying levels of fraud risk associated with each transaction method.

- Merchant’s Industry: The industry your business operates in can also affect processing fees. Certain sectors might experience higher fees due to the perceived risk of chargebacks or fraud within that industry.

The Significance of Understanding Card Processing Fees for Merchants

For businesses, especially those in the SME sector, every penny counts. Understanding the different components that make up your credit card processing fees is crucial for several reasons:

- Pricing Strategy: Being aware of these fees can help you better price your products or services, ensuring that you’re not inadvertently eroding your profits.

- Budget Planning: Knowledge of these fees aids in more accurate budgeting and financial forecasting. It allows you to anticipate expenses related to payment processing more effectively.

- Choosing the Right Payment Solutions: Armed with this information, you can make more informed decisions about which payment processors or types of transactions are most cost-effective for your business.

- Compliance and Cost Savings: Especially in the context of debit card fees, understanding the differences in fee structures between credit and debit card transactions can lead to significant savings and ensure you’re in compliance with industry standards.

In the next section, we’ll dive into the world of Rescue Payments’ Zero-Fee Processing, a solution designed to help your business navigate the complexities of these fees while maximizing profitability.

Rescue’s Zero-Fee Processing: A Game-Changer for Merchants

In the dynamic landscape of commerce, credit card processing fees are an undeniable reality for merchants. But what if there was a way to turn this challenge into an opportunity? This is where Rescue Payments steps in, transforming the way Canadian businesses handle transaction costs with our innovative zero-fee processing model.

Revolutionizing Credit Card Processing

Our zero-fee processing approach is simple in concept yet powerful in impact. Here’s how it works:

- Offsetting Transaction Costs: Instead of absorbing the credit card processing fees as a cost of doing business, our model allows you to pass on a small surcharge to the customer who chooses to pay with a credit card. This surcharge is carefully calculated to comply with Canadian regulations, ensuring transparency and fairness for all parties involved.

- Maintaining Cost-Effectiveness: For customers opting to pay with a debit card, where surcharges are not applicable, standard lower fees apply. This flexibility ensures that your business remains cost-effective and customer-friendly.

The Ripple Effect of Reduced Fees

The benefits of adopting a zero-fee processing model are far-reaching:

- Enhanced Profit Margins: By significantly reducing or even eliminating processing fees, your business can maintain healthier profit margins. This is particularly beneficial for small and medium-sized businesses where every dollar counts.

- Price Competitiveness: With lower operational costs, you can offer more competitive pricing to your customers, or alternatively, invest the savings back into your business to foster growth and innovation.

- Transparent Customer Relations: Our model promotes transparency in transactions. Customers appreciate knowing exactly what they’re paying for, enhancing their trust in your business.

- Financial Flexibility: The savings garnered from reduced processing fees provide your business with greater financial flexibility, allowing you to allocate resources where they’re needed most, be it in marketing, product development, or customer service.

At Rescue Payments, we’re not just offering a payment processing solution; we’re offering a strategic advantage. By embracing our zero-fee processing model, your business can navigate the complexities of credit card transactions while safeguarding your profits and nurturing customer relationships.

Types of Credit Card Processing Fees

Navigating the world of credit card processing can often feel like a complex journey through a maze of fees. Each type of fee plays a unique role in the overall cost of accepting credit cards. For Canadian small and medium-sized businesses, a clear understanding of these fees is not just about being informed — it’s about making strategic financial decisions. Let’s break down the most common types of fees you’ll encounter.

The Various Faces of Processing Fees

- Transaction Fees: These are charged every time a customer uses a credit card to make a purchase. They usually consist of a percentage of the transaction amount plus a fixed fee. For example, you might pay 1.5% of the transaction amount plus $0.30 per transaction.

- Monthly Fees: Some payment processors charge a monthly fee for their services, which can include customer support, account maintenance, or access to online reporting tools. These fees vary but are a fixed cost, regardless of transaction volume.

- Interchange Fees: Set by the card networks (like Visa or MasterCard) and paid to the card issuer, these fees vary depending on factors such as the type of card used (e.g., rewards, corporate) and the nature of the transaction (e.g., in-person, online). They are a significant component of the overall processing cost.

- Assessment Fees: Also referred to as card brand fees, or credit card network fees, are also set by the card networks, these are typically smaller than interchange fees and are charged as a percentage of your total monthly sales volume that goes through their network.

- Additional Fees: Depending on your payment processor, you might encounter other fees like setup fees, PCI compliance fees, chargeback fees, or fees for additional services like payment gateways.

Why Understanding These Fees Matters

For a merchant, each of these fees affects your bottom line in different ways:

- Pricing Strategies: Understanding these fees helps in setting prices that accurately reflect your cost of doing business, ensuring profitability.

- Negotiating Power: Knowledge of these fees can be powerful when negotiating terms with payment processors. Being informed puts you in a better position to secure favorable rates.

- Budget Planning: A clear grasp of these fees aids in more accurate financial forecasting and budgeting, allowing you to plan for future growth and investment.

- Choosing the Right Processor: With this knowledge, you can compare different payment processors more effectively, choosing one that offers the best value for your specific business needs.

In short, a thorough understanding of credit card processing fees is crucial for any business that accepts credit card payments. It’s not just about paying the fees — it’s about strategically managing them to benefit your business.

Transaction Fees and How They Affect Your Business

- Deep dive into transaction fees and their impact on small businesses.

- How Rescue Payments’ approach minimizes these fees for each credit card transaction.

Interchange Fees and Assessment Fees Explained

- Exploring interchange and assessment fees, including how they vary based on the type of card used and card network.

- Rescue Payments’ strategy to manage these costs effectively.

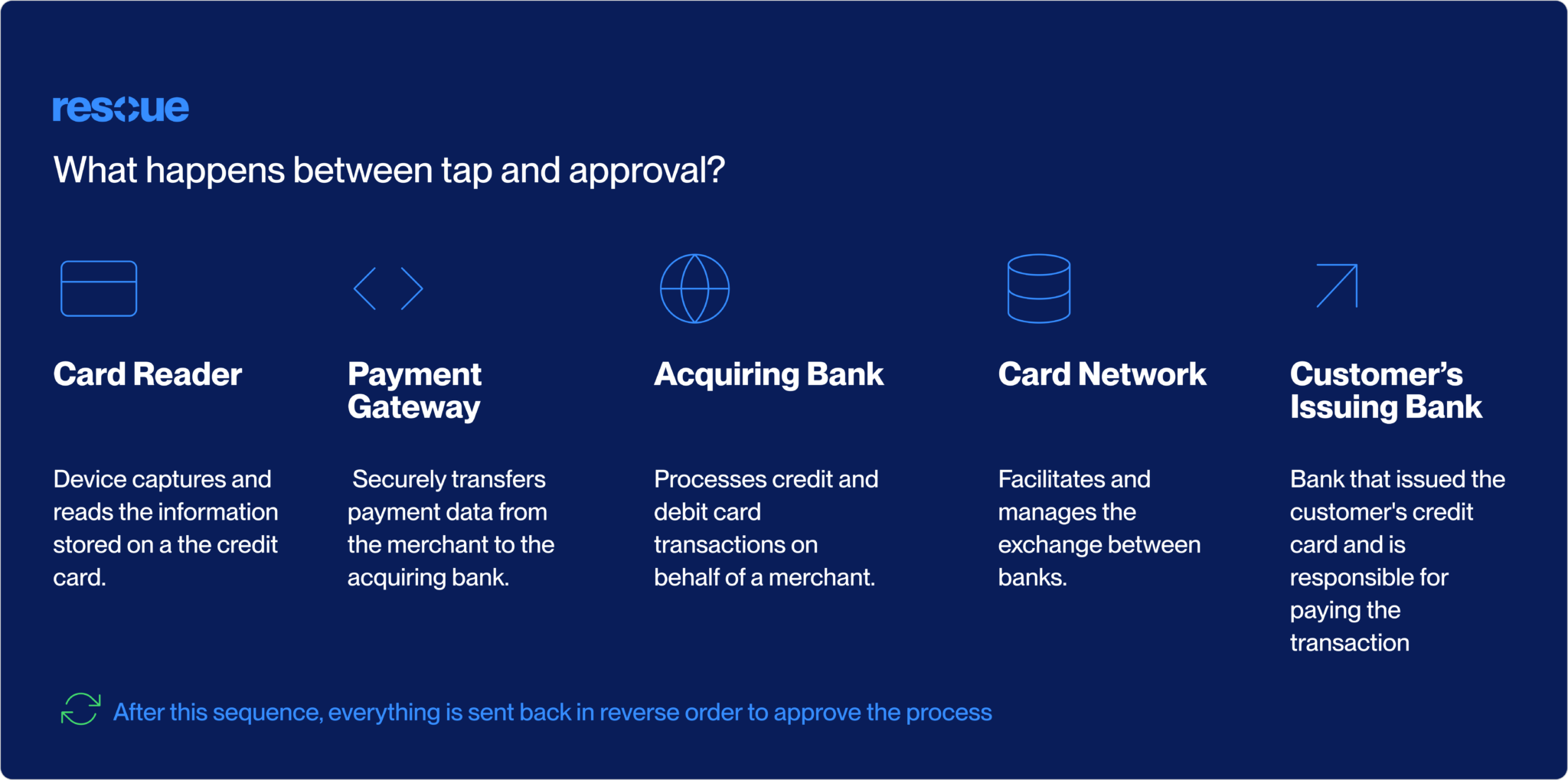

The Role of Payment Processors and Gateways

- The functions of payment processors and payment gateways in the processing of credit card payments.

- How Rescue Payments innovates in payment processing to reduce fees for merchants.

Calculating Your Business’s Credit Card Processing Fees

For any Canadian small or medium-sized business accepting credit card payments, the ability to accurately calculate processing fees is as crucial as understanding them. Each swipe, tap, or online transaction has a cost implication, and being able to anticipate these costs is key to maintaining a healthy financial strategy. Let’s demystify the process and look at how Rescue Payments simplifies it.

Breaking Down the Fee Calculation

Calculating credit card processing fees, charged by your credit card processor, involves several components:

- Interchange Fees: These are typically the largest part of the processing fees and vary depending on the card type (e.g., rewards, business), the transaction type (e.g., in-person, online), and even the card issuer. They are set by card networks and paid to the card issuer.

- Processing Fees: These are charged by your payment processor (like Rescue Payments) and can include a percentage of the transaction plus a fixed fee per transaction. They cover the services provided by the processor, including transaction processing, security, and customer support.

- Other Merchant Service Charges: This category can include monthly fees for account maintenance, PCI compliance fees, chargeback fees, and any additional service fees, depending on your specific arrangement with the payment processor.

The combination of these fees is what businesses traditionally refer to as “credit card fees”.

Simplifying with Rescue Payments

While calculating these fees might seem daunting, Rescue Payments streamlines the process:

- Transparent Pricing: We believe in clear, straightforward pricing structures. With Rescue Payments, you get a detailed breakdown of fees, so you know exactly what you’re paying for each transaction.

- Customized Solutions: Recognizing that every business is unique, we offer customized processing solutions tailored to your specific business needs, ensuring you’re only paying for what you need.

- Innovative Zero-Fee Processing: Our zero-fee processing model can significantly reduce your processing fee burden. By applying a small surcharge to credit card transactions, you can offset processing costs, making credit card acceptance more financially manageable.

- Tools and Support: We provide tools and resources to help you easily calculate and track your processing fees, and our dedicated support team is always available to assist with any questions or concerns.

Understanding and calculating your credit card processing fees doesn’t have to be a source of stress. With the right partner and the right tools, you can turn this aspect of your business into a strategic advantage, paving the way for financial success and growth.

Key Takeaways

Navigating the realm of credit card processing fees can be a complex but essential task for any small or medium-sized business in Canada. As we’ve explored the nuances of this topic, here are some crucial points to remember, along with the unique advantages that Rescue Payments offers:

Essential Points on Credit Card Processing Fees

- Varied Fee Structure: Credit card processing fees comprise various components, including interchange fees, assessment fees, and processor rates. Understanding these fees is vital for financial planning and pricing strategies.

- Influencing Factors: The type of card used, the nature of the transaction, and your industry sector significantly influence the fees you incur. Each factor plays a role in the total cost of accepting credit and debit card payments.

- Importance of Knowledge: Being informed about these fees is not just a matter of bookkeeping. It impacts your pricing, profitability, and the types of payment options you can offer, ultimately influencing customer satisfaction and your business’s bottom line.

The Rescue Payments Advantage

- Zero-Fee Processing Model: Rescue Payments revolutionizes the traditional fee structure with a zero-fee processing model, allowing merchants to pass on a surcharge to credit card transactions, thereby significantly reducing their processing costs.

- Customization and Transparency: We offer customized solutions tailored to your business needs, ensuring you pay only for what you need. Our transparent pricing means no hidden fees or surprises.

- Simplifying Fee Calculation: With tools and support from Rescue Payments, calculating and understanding your processing fees becomes more straightforward, allowing you to focus more on growing your business.

- Financial Flexibility and Savings: Adopting our zero-fee processing model not only reduces costs but also provides financial flexibility. The savings realized can be reinvested into your business, enhancing growth and competitiveness.

Remember, in the world of credit and debit card processing, knowledge is power. With Rescue Payments, you’re not just choosing a payment processor; you’re choosing a partner committed to helping your business thrive in today’s competitive marketplace.

FAQ

When it comes to credit card processing, having questions is part of the journey to understanding and making the best decisions for your business. Below are some of the frequently asked questions we encounter, along with clear, concise answers to help you navigate the complexities of payment processing.

What are the average credit card processing fees for small businesses?

- Answer: Average credit card processing fees for small businesses in Canada typically range from 1.5% to 2.9% per transaction, depending on various factors like the type of card used, the transaction method, and the merchant’s industry. It’s important to remember that additional fixed fees per transaction might also apply.

How do fees vary based on the type of card and transaction?

- Answer: Fees can vary significantly based on the type of card (e.g., standard, rewards, corporate) and the transaction method (e.g., in-person, online, keyed-in). Rewards and corporate cards usually have higher fees due to the additional benefits they offer to cardholders. Similarly, online and keyed-in transactions often incur higher fees than in-person transactions due to the increased risk of fraud.

What role does a payment processor play in my business?

- Answer: A payment processor acts as the intermediary between your business, the card networks, and the banks involved in each transaction. They handle the actual processing of credit and debit card payments, ensuring secure and efficient transfer of funds. They also provide the technology and support needed to accept card payments, from point-of-sale systems to online payment gateways.

Can you explain the difference between a payment processor and a merchant services provider?

- Answer: A payment processor primarily focuses on the actual processing of card transactions. In contrast, a merchant services provider offers a broader range of services, including payment processing, equipment leasing, merchant accounts, and additional tools like reporting and analytics. Some companies, like Rescue Payments, function as both, providing a comprehensive suite of services tailored to your business needs.

Are there ways to reduce credit card processing fees?

- Answer: Yes, there are several strategies to reduce these fees. These include choosing a pricing model that fits your business volume and type, negotiating rates with your processor, using more cost-effective transaction methods (like encouraging in-person over online transactions), and adopting solutions like Rescue Payments’ zero-fee processing model.

We hope these answers provide clarity and help you make informed decisions for your business. If you have more specific questions, our team at Rescue Payments is always ready to assist and offer tailored advice for your unique business needs.

Conclusion

As we wrap up our exploration into the world of credit card processing fees, it’s clear that managing these fees is not just a financial task, but a strategic necessity for small businesses in Canada. The landscape of digital payments is constantly evolving, and with it, the need for smart, adaptive strategies to handle the associated costs.

Embracing Efficient Fee Management

Understanding and efficiently managing credit card processing fees can significantly impact your business’s financial health. It’s about more than just keeping costs down; it’s about optimizing your operations to ensure that every transaction contributes positively to your growth and success. Whether it’s through negotiating better rates, choosing the right processing solutions, or leveraging innovative models like zero-fee processing, there are multiple avenues to explore.

Rescue Payments: Your Ally in Payment Processing

Rescue Payments stands at the forefront of this endeavor, offering not just a service, but a partnership aimed at empowering Canadian small and medium-sized businesses. Our zero-fee processing model is more than just a cost-saving tool; it’s a reflection of our commitment to supporting businesses in navigating the complex world of credit card transactions with ease and confidence.

We believe that every business, regardless of size, deserves access to payment processing solutions that are fair, transparent, and aligned with their growth objectives. With Rescue Payments, you’re not just reducing fees; you’re investing in a service that understands and responds to the unique challenges and opportunities of the Canadian market.

In conclusion, the journey of managing credit card processing fees is ongoing, but with the right knowledge and the right partner, it can lead to a path of financial efficiency and business prosperity. Rescue Payments is here to walk that path with you, every step of the way.