If you’re considering adopting a pass-the-fee model, one of the most important aspects to get right is how you communicate it to your customers. Card networks like Visa and Mastercard have strict rules around how and where surcharge notices must appear – and failing to follow them can result in fines, chargebacks, or loss of processing privileges.

In this article, we break down where these notices should be displayed, what they should say, and how Rescue Payments simplifies this process for Canadian businesses.

Why Surcharge Notices Matter

Implementing a surcharge program isn’t just about adding a fee – it’s about doing so in a way that keeps customers informed and comfortable while helping your business reduce costs.

Here’s why proper surcharge signage and messaging is critical:

1. Compliance: Both Visa and Mastercard have rules that require clear, visible notices whenever a surcharge is applied. Not following these guidelines could result in enforcement actions from card networks.

2. Avoiding Penalties: While the penalties vary, card brands reserve the right to issue warnings, suspend accounts, or impose fines for non-compliance. Playing it safe means following disclosure rules at every step of the transaction.

3. Building Customer Trust: Customers are more likely to accept a surcharge when it’s communicated clearly and professionally – before the moment of payment. No one likes to be surprised with unexpected fees, especially during checkout. Transparency builds trust and keeps payment interactions smooth.

Part 1: In-Person Surcharge Notices

For brick-and-mortar locations, customers should be informed at multiple points throughout their visit. These are the key moments where signage matters:

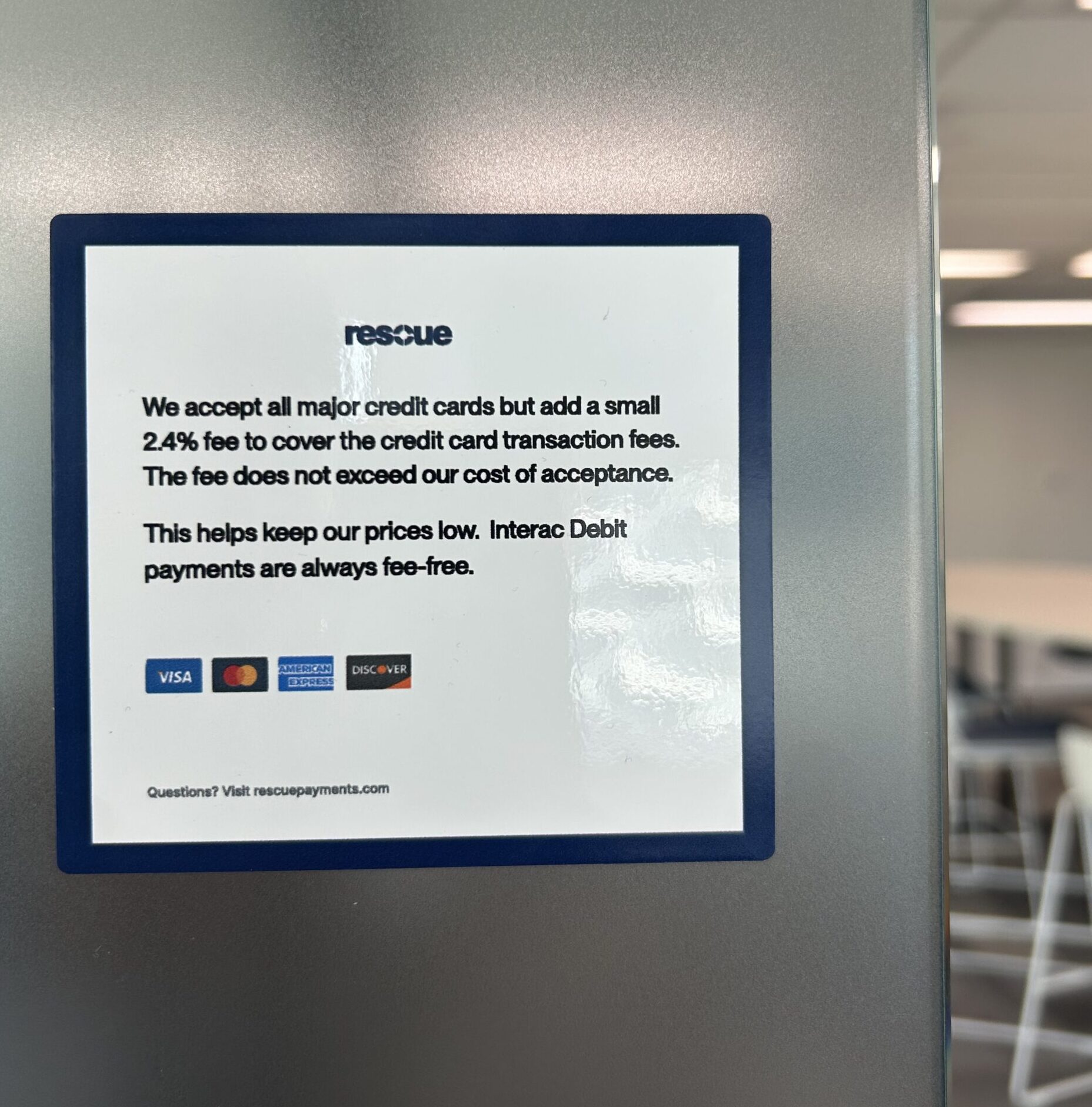

1. Entrance Notice

Purpose: Inform customers about credit card surcharges before they walk in the door.

Placement: Front door or window.

Image text:

We accept all major credit cards but add a small 2.4% fee to cover the credit card transaction fees. The fee does not exceed our cost of acceptance.

This helps keep our prices low. Interac Debit payments are always fee-free.

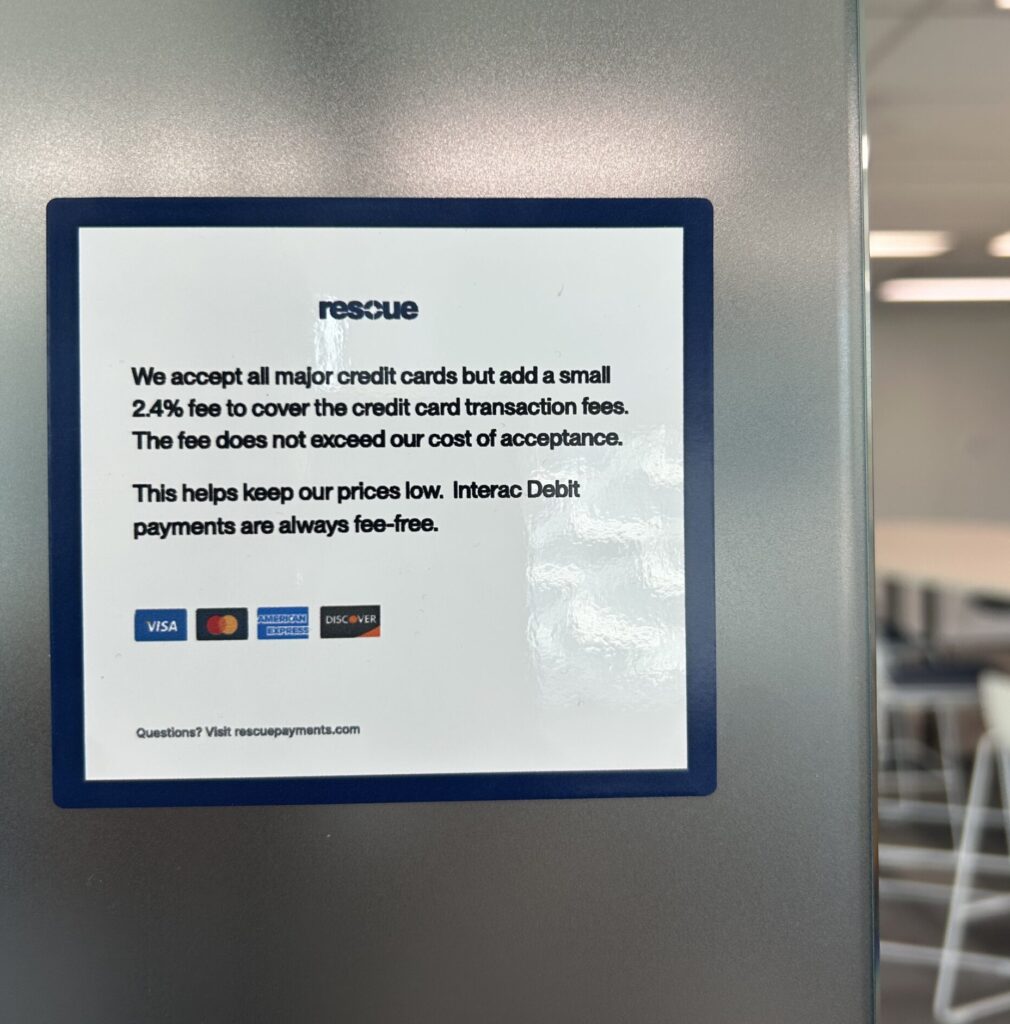

2. Point-of-Sale Notice

Purpose: Reinforce the surcharge policy at checkout.

Placement: Near the payment terminal or at the register.

Image text:

We accept all major credit cards but add a small 2.4% fee to cover the credit card transaction fees. The fee does not exceed our cost of acceptance.

This helps keep our prices low. Interac Debit payments are always fee-free.

At Rescue Payments we provide signage for merchants who have physical locations.

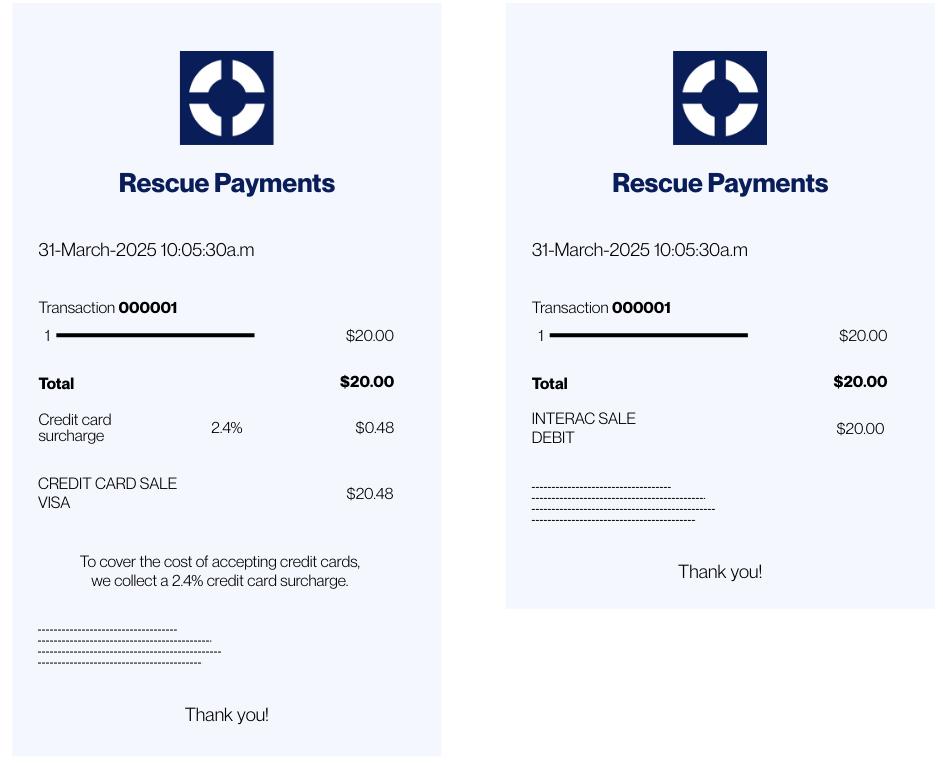

3. Receipt Disclosure

Purpose: Ensure the surcharge is reflected on the final transaction receipt.

Placement: Automatically handled by your processor.

If you’re using Rescue Payments, your system will automatically include the surcharge as a separate line item on all receipts (paper, email, and SMS). No manual action required.

Part 2: Online and Hybrid Business Surcharge Notices

For businesses that sell online – or operate in both physical and digital spaces – card networks still require that surcharge disclosures are clearly visible before a transaction is completed. But the delivery method is a little different.

Here’s how it works:

1. Hosted Checkout Page

Purpose: Ensure customers are aware of the surcharge before they finalize their payment.

Placement: On the payment screen, before the “Pay Now” button.

If you’re using Rescue Payments, this is already handled automatically. The surcharge amount appears clearly as a separate line item. There’s nothing additional you need to do to meet card brand rules here.

That said, some merchants also choose to proactively inform customers earlier in the journey, like in their website FAQ or booking/checkout flow.

Optional messaging example for pre-checkout placement:

All credit card transactions are subject to a 2.4% surcharge. To avoid this fee, you can pay by debit or cheque with no additional charge.

Or FAQ section:

To keep our prices as low as possible for all customers, we offer a no-fee option for debit and cash payments. A small fee of 2.4% is added only when using a credit card. This fee covers the cost of accepting credit card payments and is collected by our payment processor directly.

This level of transparency helps avoid surprises and can reduce drop-off at checkout.

2. Invoice Notices (Optional)

For emailed or PDF invoices, adding a short surcharge note is not required by card brands, but some merchants prefer to include a notice.

Placement: In the payment/message section or at the bottom of the invoice.

Example:

Please note: A 2.4% surcharge applies to credit card payments. This fee will be reflected at the time of payment.

No surcharge applies to debit, e-Transfer, or wire transfers.

If you use accounting platforms like QuickBooks or Xero, you can customize this language in your default invoice template.

Rescue Payments Makes Compliance Simple

Surcharge signage might seem like a small detail, but getting it right is essential – not only to stay compliant with Visa and Mastercard, but to maintain customer confidence at every step of the transaction.

When you partner with Rescue Payments:

- You receive a full signage package, including front-door decals and POS notices tailored for Canadian regulations.

- Your system is configured to automatically display and itemize the surcharge on digital receipts and hosted checkout pages.

- You’re set up for success – without having to figure it all out yourself.

Tips for Implementation

- Be consistent: Use the same surcharge language across all touchpoints (in-person, online, invoice).

- Don’t exceed 2.4%: This is the maximum allowed in Canada and must reflect your actual processing cost.

- Educate your staff: Make sure your team can explain the fee and offer surcharge-free alternatives like debit or e-Transfer.

- Think of it as communication, not just compliance: Clear and friendly messaging helps customers understand and accept the fee.

Putting it All Together

The credit card surcharge model isn’t just about covering costs—it’s about reclaiming margin and keeping your business sustainable. When rolled out thoughtfully, with transparent notices and professional signage, most customers understand and accept the change without issue.

Whether you’re still evaluating the model or ready to roll it out, Rescue Payments is here to help you do it right – with tools, guidance, and support designed for Canadian businesses.

Want help setting up a compliant, customer-friendly surcharge program? Let’s talk.