The Fine Print

Understanding Surcharges, Fees and Everything in Between

What gets covered by the surcharge?

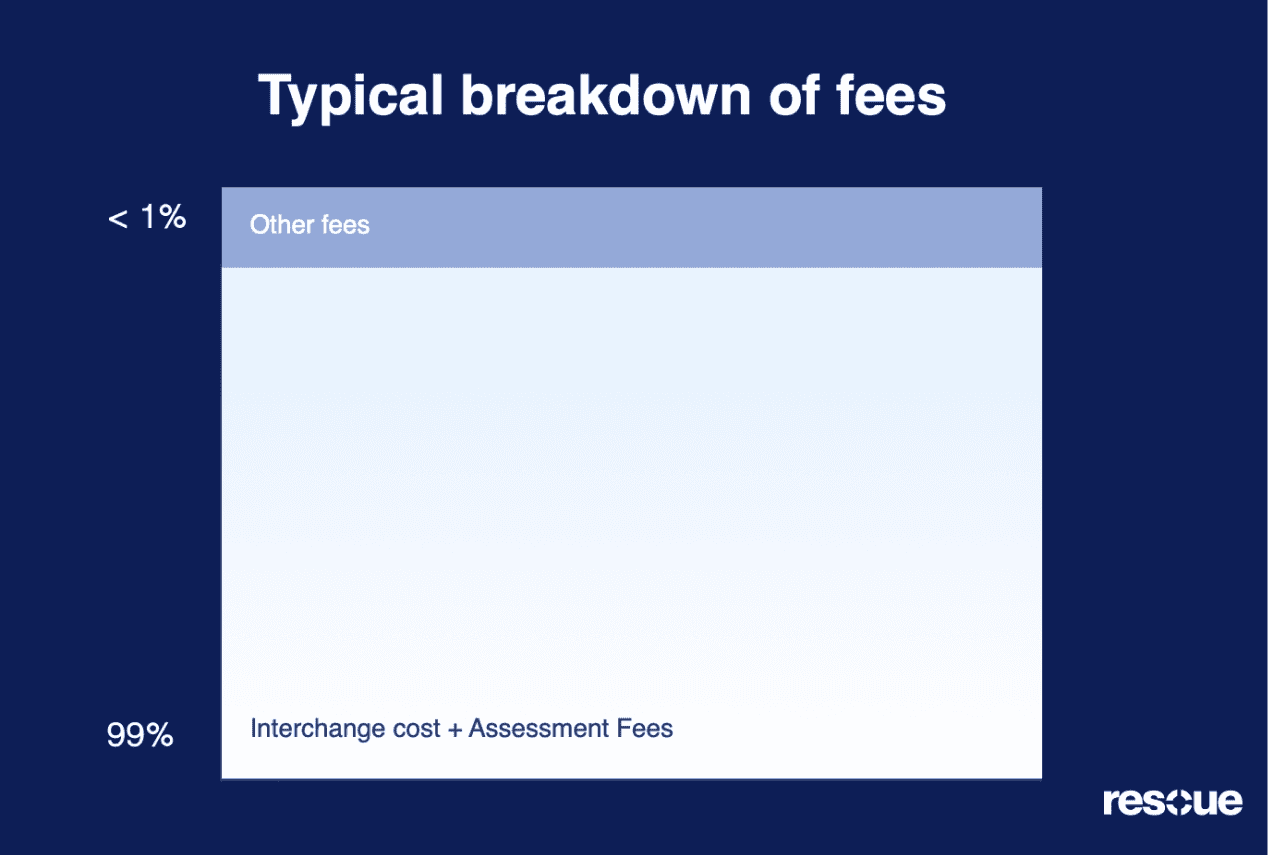

Outside of processor rates, the two largest cost centres to any credit card transaction are the Interchange cost (the cost that the card brands set for each and every card in circulation), as well as the Assessment fees, a.k.a. card brand fees (the fees to cover the costs of maintaining and improving the credit card network’s infrastructure, managing fraud and security, and providing services such as authorization and settlement of transactions).

When we look at the overall cost of accepting a transaction, these two fees traditionally make up 99% of the actual cost of a card transaction.

What doesn’t get covered by the surcharge?

There are a handful of what are traditionally known as “Pass Through Fees” which aren’t covered by the Surcharge according to the rules set by Visa and Mastercard.

Note that Assessment Fees are often included in lists like these, but they are covered by the surcharge.

So what does this look like in reality for my business?

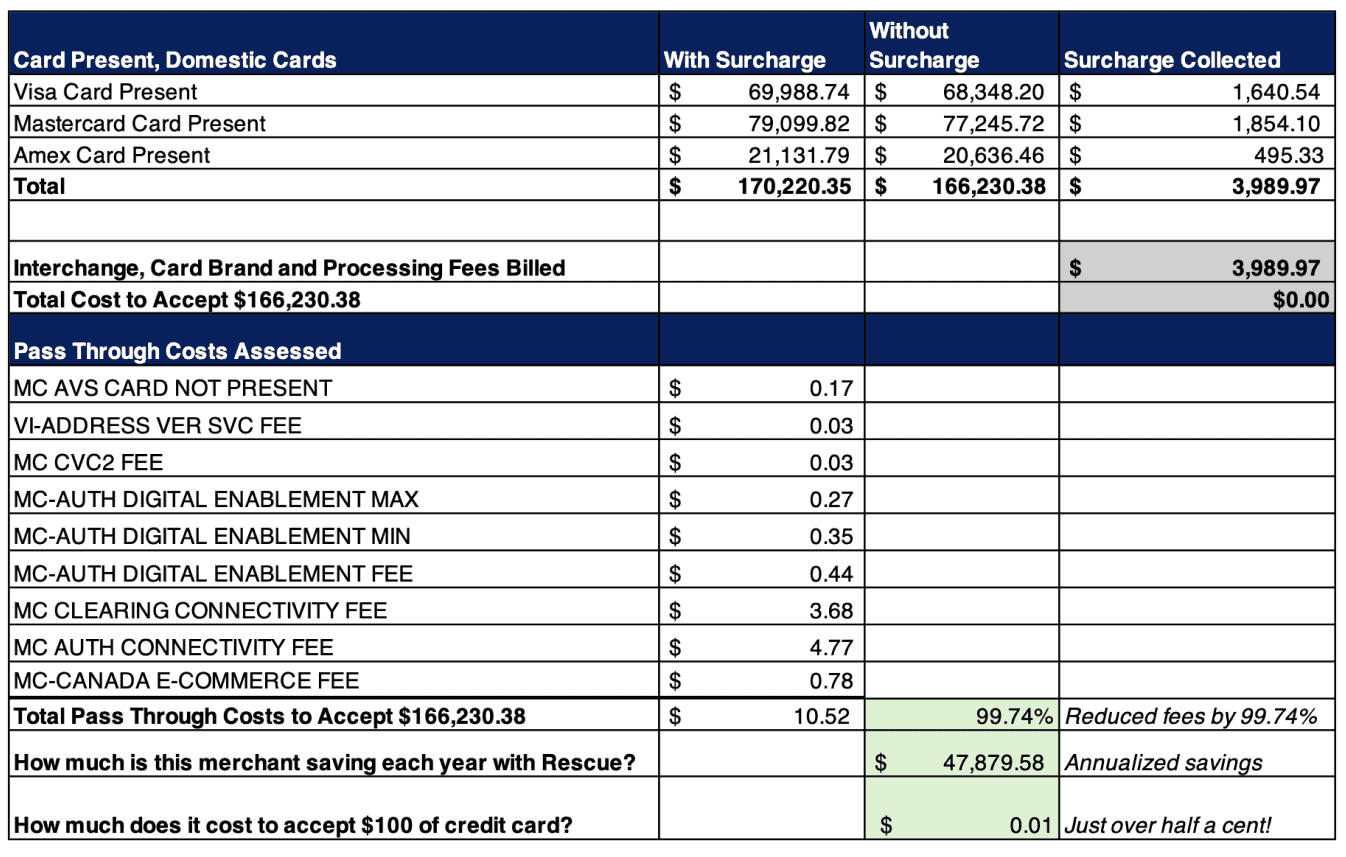

If you are a business accepting card present payments, on a physical terminal, eg a “chip and pin” transaction, you will likely fall into the bucket of saving 99.7% of all your credit card fees that you used to pay.

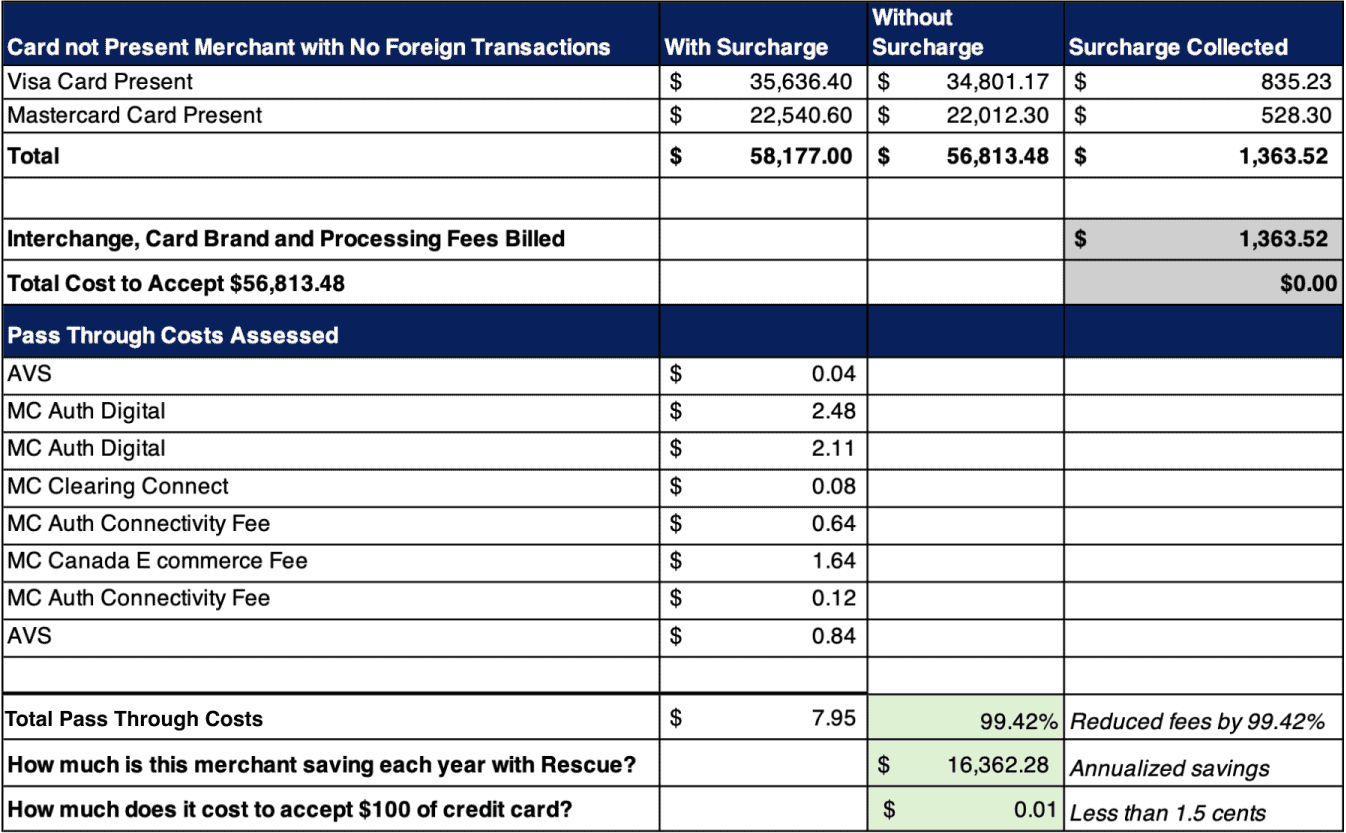

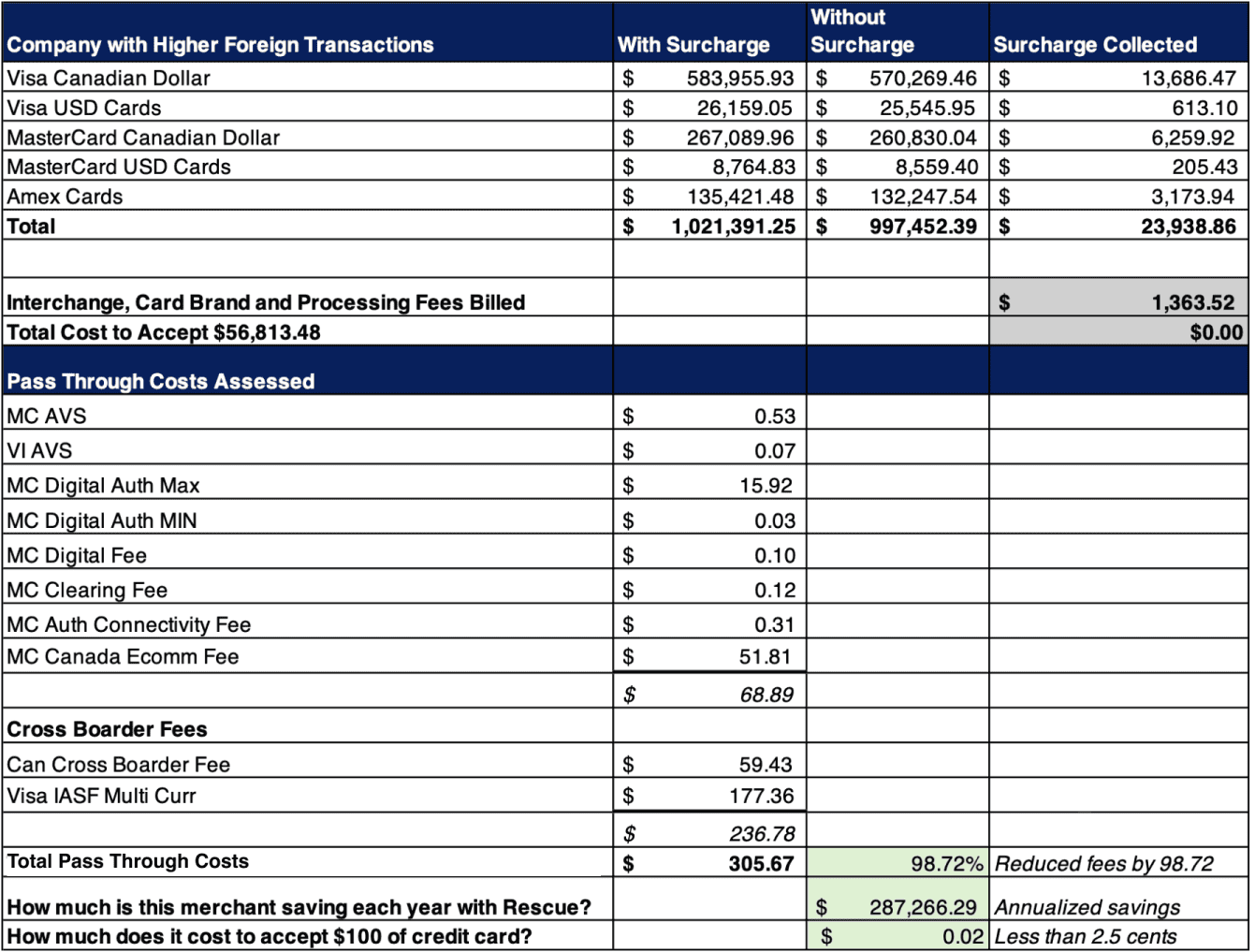

If you accept different types of payments like e-commerce, lots of international cards or take payments over the phone, then some of the additional fees might apply. To illustrate this, see below for some real world examples, from our actual clients.

Let’s look at some examples

This is a merchant that accepts mostly card-present credit card payments. You can see from their processing volume that the total cost to accept $166,230.38 in payments was only $10.52 and the business will save over $47,879.58 in fees.

In the next case, this business takes payments through a virtual terminal. You can see from their processing volume that the total cost to accept $56,813, in payments was only $7.95 and the business will save over $16,362.28 in fees.

Do you accept a lot of foreign credit cards? Here is how that looks with a surcharge program. The total cost to accept $1,021,391.25, in payments was only $305.67 and the business will save over $287,266.29 in fees.

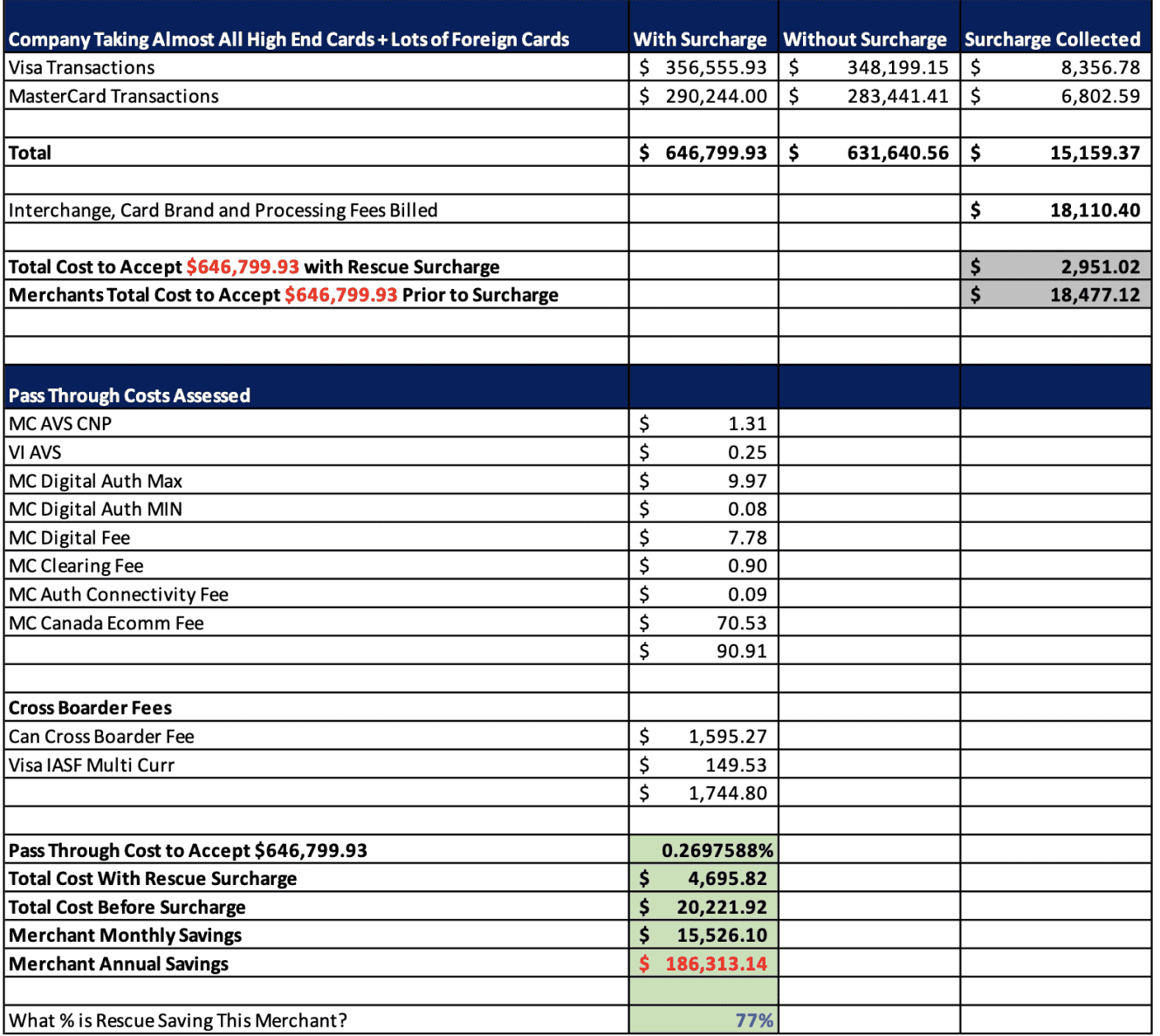

Ok, so lets say you accept a lot if high-priced cards (usually business cards) and you do a lot of foreign transactions. Here is how that looks with a surcharge program. The total cost to accept $646,799.93, in payments was only $2,951.02 and the business will save over $186,313.14 in fees.

That’s how it works!

So as we can see, most merchants save 97%+ on the processing costs. But the details can matter, so hopefully these real world examples are a helpful resource as you consider a surcharge program.

Take the next step

Ask us anything, seriously! Book a call, chat with an Onboarding Specialist or email us 24/7.

Book a Call

I want details on how this can work for me.

Get Started

I’m ready to go, I’m sick of paying fees.

- Eliminate credit card fees

- Save thousands per month

- 100% Compliant