Guides and Resources

5 Steps to Launch a Compliant Pass the Fee Program in your Dealership

When done right, a pass-the-fee program is one of the most straightforward, high-impact ways for dealerships to protect their margins. But success isn’t just about flipping a switch – it’s about launching with confidence, compliance, and clarity. From legal obligations to staff preparation, this is your go-to checklist for rolling…

How One Dealer Group Saved $366,886 with a Pass the Fee Rollout

For modern dealership groups, margin compression is a constant challenge. Between rising operating costs, credit card fees, and pressure to maintain CSI scores, profitability is often dictated not by how much you sell, but by how efficiently you operate. That’s why one national dealer group made the decision to implement…

Is Your Surcharge Program Compliant? Here’s What Dealers Need to Know

Running a dealership means managing thin margins, rising operating costs, and complex vendor relationships. For many dealers, a compliant surcharge program offers a smart way to recover credit card processing fees without raising prices. But there’s a catch: non-compliance can cost you more than the fees ever did. Visa and…

Smart Margin Growth for Dealerships: Recover Revenue Without Raising Prices

Raising prices isn’t always an option. Sticker shock can lose sales, damage reputation, and slow down volume. Yet margin pressure never disappears. For dealerships serious about protecting profitability, the real opportunity isn’t just in selling smarter-it’s in operating smarter. That means finding hidden costs, recovering lost revenue, and improving the…

The True Cost of Credit Card Processing for Dealerships – and How to Reclaim It with a Pass-the-Fee Programs

Profitability isn’t just about selling cars anymore. For dealerships today, real performance is measured in operational precision – and every overlooked cost adds up faster than ever. While fixed operations have traditionally been a dependable source of gross profit, even these departments are feeling the strain of rising operating expenses…

Chargebacks: What You Can (Actually) Do to Prevent Them

Rescue Payments understands the full risk picture, not just your processing fees. When businesses think about payment processing, the conversation usually starts with fees. And that makes sense – for many businesses, payment processing represents one of their largest monthly operating expenses. But behind the scenes, there’s another important consideration:…

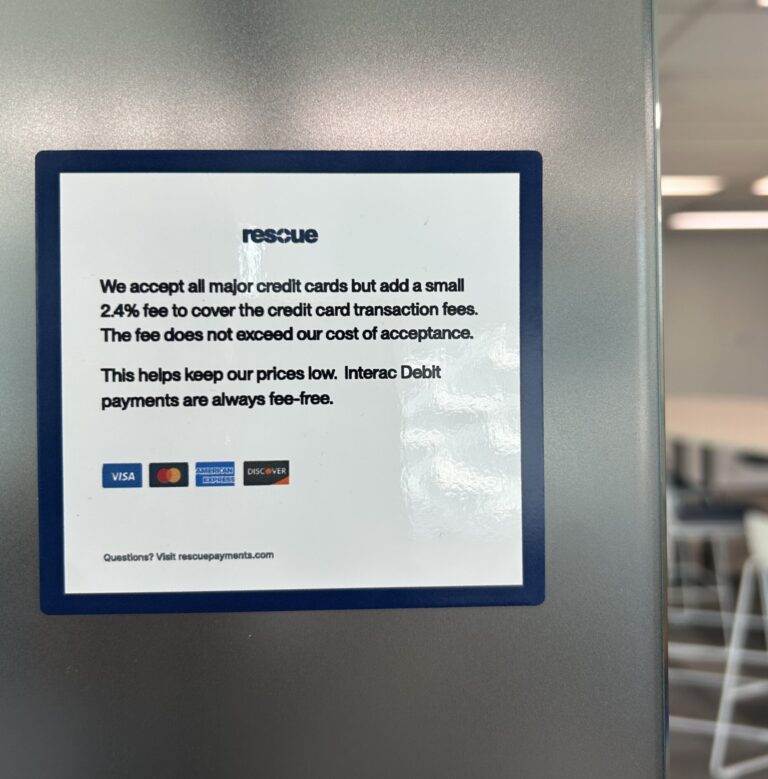

Credit Card Surcharge Notice: Examples and Templates for Canadian Companies

If you’re considering adopting a pass-the-fee model, one of the most important aspects to get right is how you communicate it to your customers. Card networks like Visa and Mastercard have strict rules around how and where surcharge notices must appear – and failing to follow them can result in…

Is It Worth Paying Credit Card Surcharges to Earn Rewards in Canada?

Credit cards have long been a popular method of payment for Canadians, not only for the convenience they provide but also for the rewards they offer. From cashback to travel points and gift cards, Canadian credit card users often find themselves weighing the pros and cons of swiping their cards…

Unlocking Financial Success: Why Students Should Consider a Credit Card

As a student, the idea of getting a credit card can be intimidating. Many students avoid credit cards because they worry about falling into debt, or they simply don’t understand how to use them responsibly. However, when used wisely, credit cards can be one of the most effective tools for…

Starting up a business? Why you should surcharge from day one and save thousands on credit card fees.

Starting a business brings in a world of choices and it can sometimes be a bit overwhelming as you begin to put everything in place. How you accept payment is one of the more confusing parts of the process because of the overwhelming amount of choices in the market. .…