Introduction

For small business owners, navigating the terrain of daily expenses and operational costs can be daunting. Here, cheap credit card processing doesn’t just represent a way to accept payments; it’s a strategic tool in managing overall costs and boosting profitability.

Emphasizing cheap credit card processing is not about compromising quality or security; it’s about smart business. It’s about ensuring that the cost of accepting credit card payments doesn’t erode your profits. By understanding these concepts and the significance of affordable processing options, small business owners can position themselves to make savvy decisions that support their business’s growth and financial health.

TL;DR: In order to process a credit card, there are a few must have items;

- A valid business and bank account

- A valid merchant account, tied to your business, with a payment processor

- Either a physical or virtual “device” that allows you to authorize and accept card payments

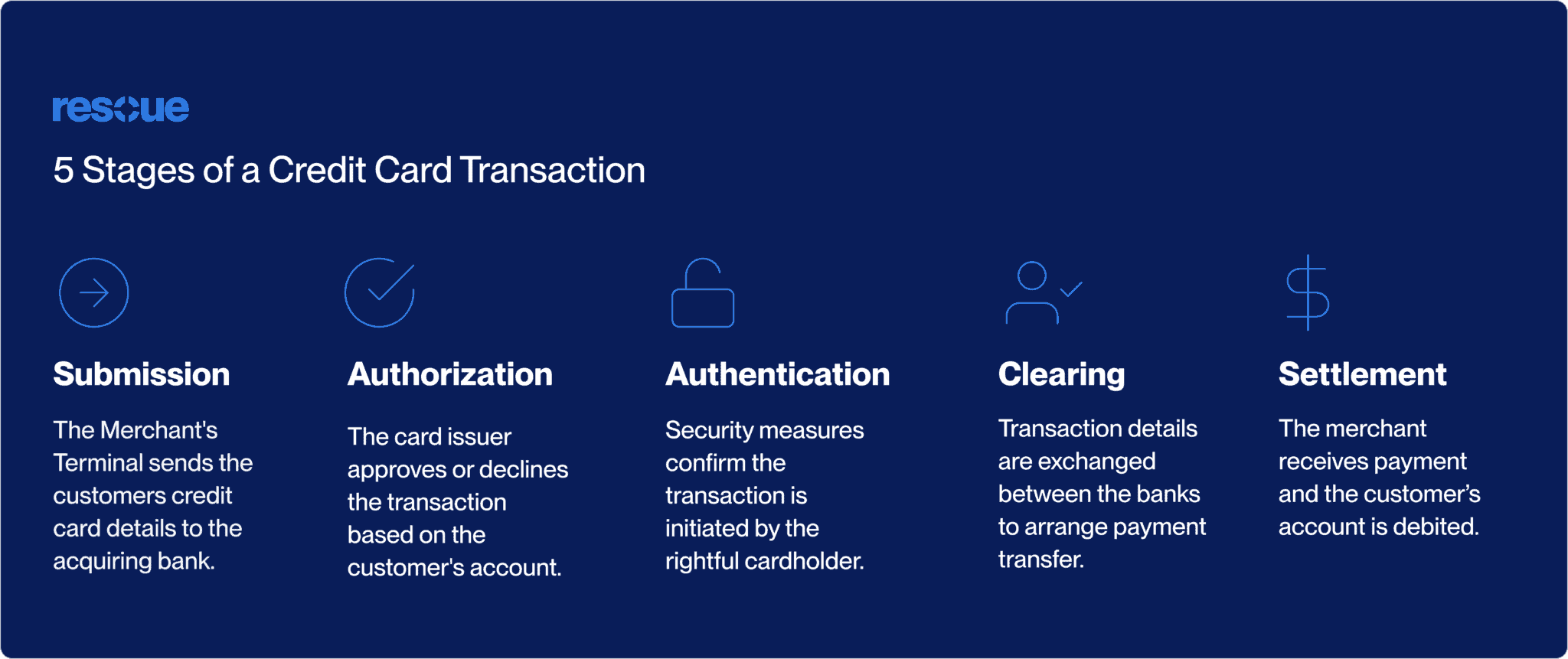

The simplified steps from when a transaction begins to when you are paid:

- Customer presents their card for payment

- Card Data and Transaction Data are sent to the issuing bank, card brands (Visa/MasterCard), and the payment processor

- All parties provide a response in relation to the transaction being attempted. If all good, approval is given

- Receipt for the transaction is generated

- Funds land in a merchants bank the next business day

All of the above should be wrapped in a nice complaint and secure bow. Allowing merchants to run their business daily without the concern or worry above the security and stability of their merchant account.

Rescue Payments elevates the credit card processing experience for Canadian small and medium-sized businesses by seamlessly blending state-of-the-art technology, custom-tailored solutions, and stringent security measures. With a keen focus on catering to the unique demands of the Canadian market, Rescue Payments distinguishes itself through its innovative Android-based devices that simplify surcharges, enabling businesses to offer zero-fee processing accounts. Beyond just processing transactions, Rescue Payments empowers businesses with omnichannel solutions that encompass in-person, online, and telephone transactions, all while ensuring PCI DSS compliance to protect customer data.

Cheap Credit Card Processing: What Small Business Owners Need to Know

Understanding Credit Card Processing Fees and Rates

Understanding credit card processing is crucial for making informed decisions, so here is how it works. At its core, when a customer makes a credit card purchase the process hinges on several key steps: the merchant (that’s you, the business owner), the customer, the payment processor or payment service provider, the issuing bank (the customer’s bank), and the acquiring bank (the merchant’s bank). When a customer swipes or taps their card, the payment processor acts as a liaison between these entities, ensuring the transaction is authorized and funds are transferred securely.

In this ecosystem, fees are inevitable. They come in various forms, such as transaction fees, processing fees, interchange fees, and possibly monthly or annual fees. For small businesses, these fees can quickly add up, making the pursuit of the cheapest credit card processing options not just appealing but necessary. Cheap credit card processing can mean lower transaction fees, more favorable processing rates, or minimal monthly charges. It’s about finding a balance between cost-effective solutions and reliable, efficient service that meets your business’s unique needs.

Getting Lower Credit Card Processing Fees and the Best Credit Card Processing

Navigating the world of credit card processing for small business might feel like a complex dance, but with the right steps, small business owners can effectively negotiate lower rates. It’s about mastering the art of negotiation and understanding your business’s specific needs. The simplest way to lower fees to basically zero is to implement a surcharge program.

Strategies to Reduce Your Processing Costs

- Know Your Numbers: Before you approach negotiations, arm yourself with data. Understand your monthly processing volume, average transaction size, and the types of cards you frequently process (such as rewards cards or corporate cards). This information paints a picture of your business’s specific needs and processing habits, making you a more informed negotiator.

- Research the Market: Knowledge is power. Research the rates and fees offered by various processors. This information will give you a benchmark for negotiations and help you identify competitive offers.

- Leverage Your Transaction Volume: If your business processes a high volume of transactions, use this as a bargaining chip. Payment processors offer lower rates for higher volumes, as your business represents more significant revenue for them.

- Ask for Interchange-Plus Pricing: Interchange-plus pricing can be more transparent and often cheaper than tiered pricing models. In this model, you pay the interchange fee (set by the card networks) plus a fixed markup from your processor. Requesting this pricing model can lead to savings, especially if you have a clear understanding of your average transaction size and volume.

- Highlight Your History: If you have a history of low chargebacks and a strong credit history, mention this. Processors might offer better rates to businesses that pose a lower risk.

Importance of Understanding Your Processing Needs and Volume

The key to finding the cheapest payment processing lies in an understanding of your business’s unique processing profile. Not all businesses are the same, and therefore, not all processing needs are identical. For example, a small café might have a high number of low-value transactions, while a boutique might process fewer, higher-value sales. Each scenario requires a different approach to negotiating fees.

Understanding your processing needs and volume helps in two ways:

- Targeted Discussions: When you know your business’s specific processing patterns, you can focus your negotiations on the fees that most impact your costs. For instance, if you have many small transactions, a lower per-transaction fee might be more beneficial than a lower percentage rate.

- Informed Decisions: Understanding your needs enables you to evaluate offers more effectively. You’ll be able to discern which pricing model or offer truly aligns with your business, avoiding the pitfalls of seemingly low rates that don’t match your transaction profile.

In summary, the journey to lower credit card processing fees is not just about haggling over percentages. It’s a strategic process that requires knowledge of your business’s processing habits, an understanding of the market, and the ability to articulate your needs clearly.

Processing for Small Businesses: Tailoring Solutions to Fit Your Business for the Cheapest Credit Card Processing

Credit Card Network and Card Processing Rates: Maximizing Benefits

Understanding the intricate role of card networks and the variability of processing rates is crucial for any small business aiming to maximize benefits and minimize costs. This understanding not only equips you with the knowledge to make informed decisions but also opens doors to potentially more favorable rates and terms.

Understanding the Role of Card Networks in Processing Rates: Monthly Fees, Merchant Services and Processing Services

Card networks, such as Visa, MasterCard, and American Express, play a pivotal role in determining the processing rates you pay. They set the interchange fees, which are the base costs that all merchants must pay to process credit and debit card transactions. These monthly fees vary depending on several factors, including the type of card used (e.g., credit, debit, rewards, corporate), the transaction size, and your industry.

Understanding these networks and their fee structures is crucial because:

- Predictability of Costs: Knowing the standard interchange rates set by these networks can help you anticipate your processing costs more accurately for your merchant account.

- Negotiation Leverage: This knowledge can be a powerful tool in negotiations with your payment processor, especially when discussing interchange-plus pricing models.

How Processing Rates Vary with Different Card Types

The type of card used in a transaction significantly impacts your processing rates. Generally, credit cards tend to have higher processing fees than debit cards, primarily due to the higher risk and rewards programs associated with credit cards. Additionally, certain types of credit cards, like those offering rewards or miles, may carry even higher fees.

Key differences include:

- Debit Cards: Often have lower interchange fees, making them a more cost-effective option for merchants.

- Credit Cards: Tend to have higher fees but are more commonly used for larger purchases.

- Specialty Cards: Cards such as business or rewards cards often incur higher fees due to the additional benefits they provide to cardholders.

Exploring the Variety of Payment Processing and Service Providers for Your Business

Diving into the world of payment processing reveals a spectrum of options tailored to various business needs. It’s not just about accepting credit and debit cards; it’s about finding the right mix of payment solutions that align with your customer preferences and business model.

Considerations for your business may include:

- Traditional Terminals: Ideal for brick-and-mortar stores, offering reliable and secure transactions.

- Mobile and Contactless Options: Catering to the growing demand for contactless and on-the-go payments.

- E-commerce Solutions: For businesses with an online presence, ensuring seamless and secure online payment processing.

- Integrated Systems: Combining POS systems with payment processing for streamlined operations.

By understanding the nuances of card networks, the impact of different card types on processing rates, and exploring the breadth of payment processing options available, you can strategically tailor your payment processing setup. This not only enhances the customer experience but also positions your business to effectively manage costs, ultimately contributing to a healthier bottom line.

Payment Processing Companies: The Landscape in 2024 for Canadian Small Businesses

In 2024, the landscape of payment processing companies in Canada continues to evolve, offering small businesses a plethora of options tailored to their unique needs. Understanding the current market trends and identifying the best payment processors are key steps towards ensuring efficient, cost-effective transactions for your business. Let’s delve into what Canadian small businesses need to know to navigate this dynamic space.

Analysis of Current Market Trends and Top Credit Card Processing Companies in Canada

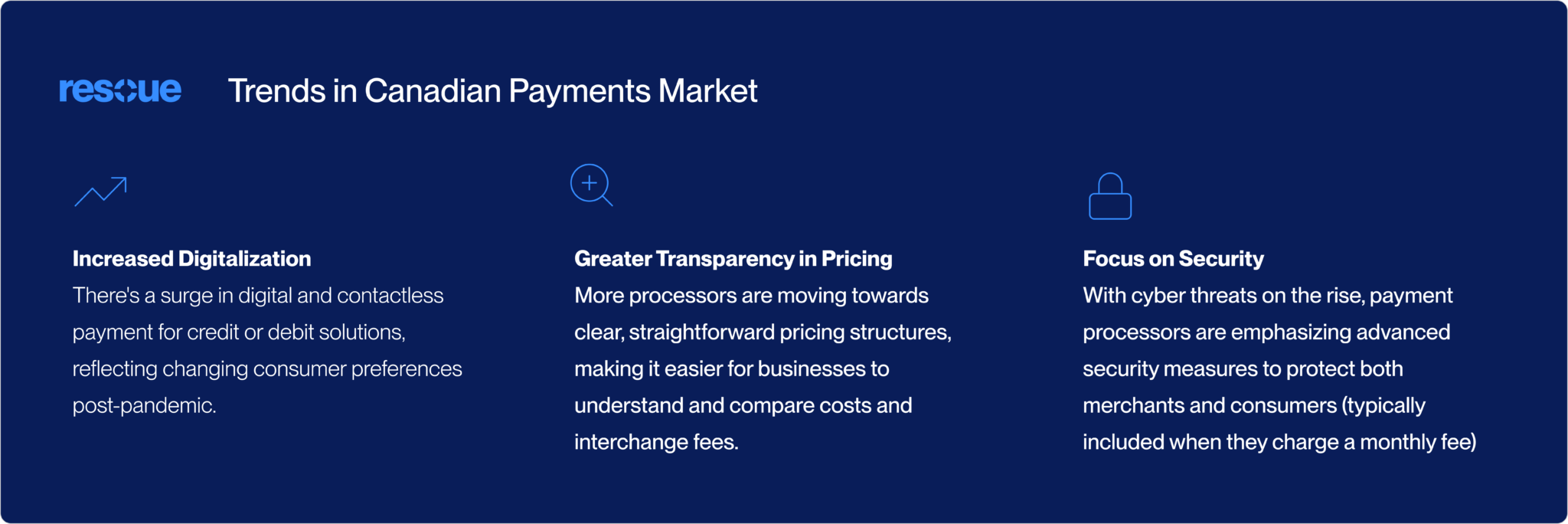

The Canadian payment processing scene in 2024 is marked by a few notable trends:

- Increased Digitalization: There’s a surge in digital and contactless payment for credit or debit solutions, reflecting changing consumer preferences post-pandemic.

- Greater Transparency in Pricing: More processors are moving towards clear, straightforward pricing structures, making it easier for businesses to understand and compare costs and interchange fees.

- Focus on Security: With cyber threats on the rise, payment processors are emphasizing advanced security measures to protect both merchants and consumers (typically included when they charge a monthly fee)

Top processors in Canada that cater to small businesses typically offer a mix of these features when evaluating credit card companies. They include both global players and local Canadian firms, each bringing different strengths, such as competitive rates, robust customer support, or specialized services for certain types of transactions.

Factors to Consider When Choosing a Payment Processor

For Canadian small businesses, selecting the right payment processor involves balancing various factors:

- Competitive Fees and Rates: Look for processors offering lower credit card processing fees and favorable rates. Pay particular attention to interchange fees, as well as any additional charges like monthly fees or terminal rental costs.

- Type of Transactions: Consider the nature of your transactions (online, in-store, mobile, in-person payment) and choose a processor that excels in handling your most common transaction types.

- Integration with Existing Systems: Ensure the processor’s technology integrates seamlessly with your current POS systems, accounting software, and other business tools/

- Customer and Technical Support: Opt for processors with a reputation for strong customer support, crucial for resolving any issues quickly and minimizing downtime.

- Contract Terms and Flexibility: Be wary of long-term contracts and early termination fees. Look for processors offering flexibility, which is particularly important for small businesses that may experience fluctuations in sales volume.

- Security and Compliance: Ensure the processor adheres to the highest security standards, including PCI DSS compliance, to protect sensitive payment information.

- Reputation and Reviews: Research other businesses’ experiences with the processor. Look for feedback from businesses similar in size and scope to yours.

- Additional Services: Consider if additional services offered, like analytics or loyalty programs, can add value to your business.

In-Person and Online Credit Card Transactions for Small Businesses

Mobile Card Reader and Payment Gateway: Expanding Your Payment Options

Benefits of Using Mobile Card Readers and Online Payment Gateways

- Increased Mobility and Convenience: Mobile card readers enable transactions anywhere, from outdoor markets to customer homes, making them ideal for businesses on the move. Online payment gateways facilitate easy, secure transactions on your website, catering to the growing trend of online shopping.

- Enhanced Customer Experience: Offering a variety of payment methods, including mobile and online options, caters to customer preferences, enhancing their overall experience with your business.

- Streamlined Operations: Both mobile readers and online gateways typically come with integrated software for tracking sales, inventory, and customer data, streamlining business operations.

- Improved Cash Flow: Faster processing of electronic payments through these methods can lead to quicker access to funds, improving cash flow management.

Comparison of In-Person and Online Payment Solutions

While both mobile card readers and online gateways serve the same fundamental purpose—processing credit and debit card payments—their applications differ based on your business model.

- In-Person Transactions: Mobile card readers are ideal for face-to-face transactions, providing a portable, user-friendly solution. They’re perfect for businesses without a fixed location or for adding flexibility to a traditional setup.

- Online Transactions: Online payment gateways are essential for e-commerce and any business offering online services or products. They provide a secure, efficient way to handle transactions remotely.

In both scenarios, the ability to process various types of credit and debit cards is crucial, as it broadens the range of customers you can serve.

Subscription Fee and Termination Fee: Hidden Costs Explained

Navigating the world of credit card processing often means encountering a range of fees, some more apparent than others. Among these, subscription fees and termination fees are less obvious but can significantly impact your business’s financial health. Understanding and managing these fees is crucial for maintaining a cost-effective payment processing system, especially for small businesses where every dollar counts.

Avoiding Unnecessary Fees in Credit Card Processing

- Subscription Fees: These are periodic charges, often monthly, that some processors levy for the use of their services. While they might seem small, over time, they can add up, eating into your profits.

- Termination Fees: These fees are charged if you decide to end your contract with a processor before the agreed term is up. They can be particularly burdensome for small businesses that may need to switch processors due to changing needs.

Identifying and Understanding These Fees

- Read the Fine Print: When signing up with a processor, thoroughly review the contract. Look for any mention of subscription or termination fees. Understanding these terms upfront can save you from future surprises.

- Ask Questions: Don’t hesitate to ask the provider to clarify any fees you don’t understand. A reputable provider should be transparent and willing to explain all charges.

Strategies to Avoid or Minimize Additional Costs

- Negotiate Terms: Before signing a contract, negotiate the terms for your credit card processing rates. If there are subscription fees, see if they can be lowered or waived based on your transaction volume. Similarly, negotiate lower or no termination fees, especially if you’re unsure about a long-term commitment.

- Choose Month-to-Month Contracts: Opt for processors that offer month-to-month contracts to avoid hefty termination fees. This also offers more flexibility to switch processors without incurring penalties.

- Assess Your Needs Regularly: Regularly review your processing needs and costs. If you find that you’re paying for services you don’t use, it might be time to renegotiate your contract or switch processors.

The Benefits of the Surcharge Model for Small Businesses

The surcharge model presents an alternative approach that can be particularly advantageous for many small businesses. In this model, businesses add a small surcharge to transactions when customers choose to pay with credit cards. This approach offers several benefits:

- Offset Processing Costs: The surcharge helps offset the costs associated with processing credit card payments, easing the financial burden on the business.

- Transparency: Customers are aware of the surcharge and can choose to pay with a different method if they prefer, fostering transparency in transactions.

- Flexibility and Fairness: The surcharge model allows businesses to pass on the cost of credit card transactions to those who choose to use them, which can be seen as a fairer approach.

- Savings on Fees: By offsetting processing costs, businesses can save on the overall fees they pay, which can be particularly significant for businesses with slim margins.

- Regulatory Compliance: It’s important to ensure that implementing a surcharge model complies with local regulations and card network rules. In many jurisdictions, this model is perfectly legal and a viable option for businesses.

In conclusion, understanding and managing hidden fees like subscription and termination fees is crucial for small businesses. By being vigilant, negotiating better terms, and considering alternative models like surcharging, businesses can significantly reduce their credit card processing costs, enhancing their overall profitability and financial stability.

Key Takeaways

For small business owners, mastering the art of cheap credit card processing is not just a necessity, but a strategic move towards sustainable growth. This journey involves a deep dive into the workings of many payment processors, understanding their fee structures, and making informed choices that align with your business needs.

- Understanding the Ecosystem: The world of credit card processing is populated by many payment processors, each with its unique offerings. It’s essential to understand how these processors interact with banks and card networks to manage transaction fees, processing fees, interchange fees, and other potential charges. This understanding helps in finding the lowest credit card processing fees, crucial for cost-effectiveness.

- Negotiation is Key: Many businesses find success in negotiating better rates with their payment processors. By being well-informed about your monthly processing volume and the types of cards processed, you can leverage this information to negotiate more favorable terms. Opting for a payment processor that offers interchange-plus pricing can often result in more transparent and generally lower costs.

- Customizing Payment Solutions: Each business requires a unique approach to payment processing. Whether you deal with in-person transactions requiring traditional terminals or embrace the digital age with mobile and online solutions, the choice of your payment processing partner should enhance customer experience and operational efficiency. Understanding how banks and card networks influence processing rates is vital in making these decisions.

- Choosing the Right Payment Processor: The landscape of payment processors in 2024 offers a wide variety of options. From increased digitalization to a focus on security, it’s vital to choose a payment processor that offers the features that align with your business needs. This includes evaluating factors like fees and rates, type of transactions, integration capabilities, customer support, flexibility in contracts, and adherence to security standards.

- Managing Additional Costs: A significant aspect of choosing the right processor is understanding and managing hidden costs such as subscription fees and termination fees. Many businesses benefit from regularly reviewing their processing needs and choosing contracts that minimize these additional costs. Furthermore, adopting models like surcharging, where a small fee is added for credit card transactions, can offset processing costs, making it an attractive option for businesses seeking the lowest credit card processing fees.

In conclusion, navigating the realm of credit card processing requires a blend of knowledge, negotiation skills, and strategic decision-making. By understanding the nuances of how payment processors, banks, and card networks operate, small business owners can make savvy decisions that minimize costs and support their business’s growth and profitability.

FAQ (Frequently Asked Questions)

What are the key factors to consider when choosing a payment processor for my small business? When selecting a payment processor, consider factors such as their fee structure (including the lowest credit card processing fees), the types of transactions they handle (in-person, online, mobile), integration with your current systems, the level of customer and technical support, contract terms and flexibility, their compliance with security standards, the variety of payment processing rates, and their overall reputation in the market.

How can I negotiate better rates with my payment processor? To negotiate better rates, arm yourself with data about your monthly processing volume and the types of cards you frequently process. Research the market to understand the rates offered by various processors. Use your transaction volume as leverage, and ask for interchange-plus pricing for more transparency. Highlight your business’s history, like low chargeback rates or strong credit history, to strengthen your position. It’s also beneficial to work with a payment processor that understands your business’s specific needs.

What are interchange fees, and why are they important? Interchange fees are set by card networks (like Visa and MasterCard) and are paid by merchants to process credit and debit card transactions. These fees vary based on card type, transaction size, and industry. Understanding interchange fees is crucial because they form a significant part of the costs involved in credit card processing, impacting your overall payment processing rates.

What should I know about subscription and termination fees in credit card processing? Subscription fees are periodic charges levied by some processors for using their services, while termination fees are charged for ending a contract prematurely. It’s important to understand these fees to avoid unexpected costs. Negotiate these terms in your contract, consider month-to-month contracts to avoid termination fees, and regularly assess your processing needs to ensure you’re not paying for unnecessary services.

Can implementing a surcharge model benefit my business? Implementing a surcharge model, where you add a small fee to transactions when customers pay with credit cards, can help offset the costs associated with processing these payments. This can lead to savings on overall fees, especially for businesses with tight margins. Ensure that this model complies with local regulations and card network rules before implementation.

How do banks and card networks influence credit card processing? Banks and card networks play a crucial role in authorizing and settling credit and debit card transactions. They issue cards, set interchange fees, and ensure the secure transfer of funds. Their security standards, like PCI DSS compliance, are critical for protecting sensitive payment information.

Why is it important to understand my business’s processing needs and volume? Understanding your processing needs and volume helps in targeted negotiations for fees that most impact your costs and enables you to make informed decisions. For instance, a business with many small transactions might benefit more from a lower per-transaction fee than a lower percentage rate for any credit card transaction fee process.

What are the trends for payment processing fees in 2024 for Canadian small businesses? The trends include increased digitalization and contactless payment solutions, greater transparency in pricing, and a heightened focus on security. Top processors are offering competitive rates, robust customer support, specialized services, and a range of credit card readers, reflecting these trends and catering to the evolving needs of Canadian small businesses. Be sure to evaluate all of your needs to lower processing fees with your merchant services provider.

Conclusion

In conclusion, navigating the landscape of credit card processing is a journey of strategic importance for small business owners. With the right approach, it’s possible to find a credit card processor that not only meets your unique needs but also ensures that you get the cheapest rates possible without compromising on service quality. The key lies in understanding the intricate details of payment processing rates, being mindful of the various fees involved, and choosing a payment service that aligns with your business model.

Whether it’s negotiating better rates, choosing the right type of credit card readers, or deciding to implement a surcharge model, each decision plays a critical role in managing your financial health. The evolving trends in the payment processing industry, especially in the Canadian market, offer a wealth of options tailored to the diverse needs of small businesses. By staying informed and making well-considered choices, you can ensure that your credit card processing strategy is not only cost-effective but also a robust pillar supporting the growth and sustainability of your business.

Remember, the goal is not just to find the cheapest option available, but to partner with a credit card processor and payment service that offers a harmonious blend of affordability, reliability, and quality service. This balanced approach will serve as a cornerstone for the financial success of your business, allowing you to focus on what you do best – growing your business and serving your customers.