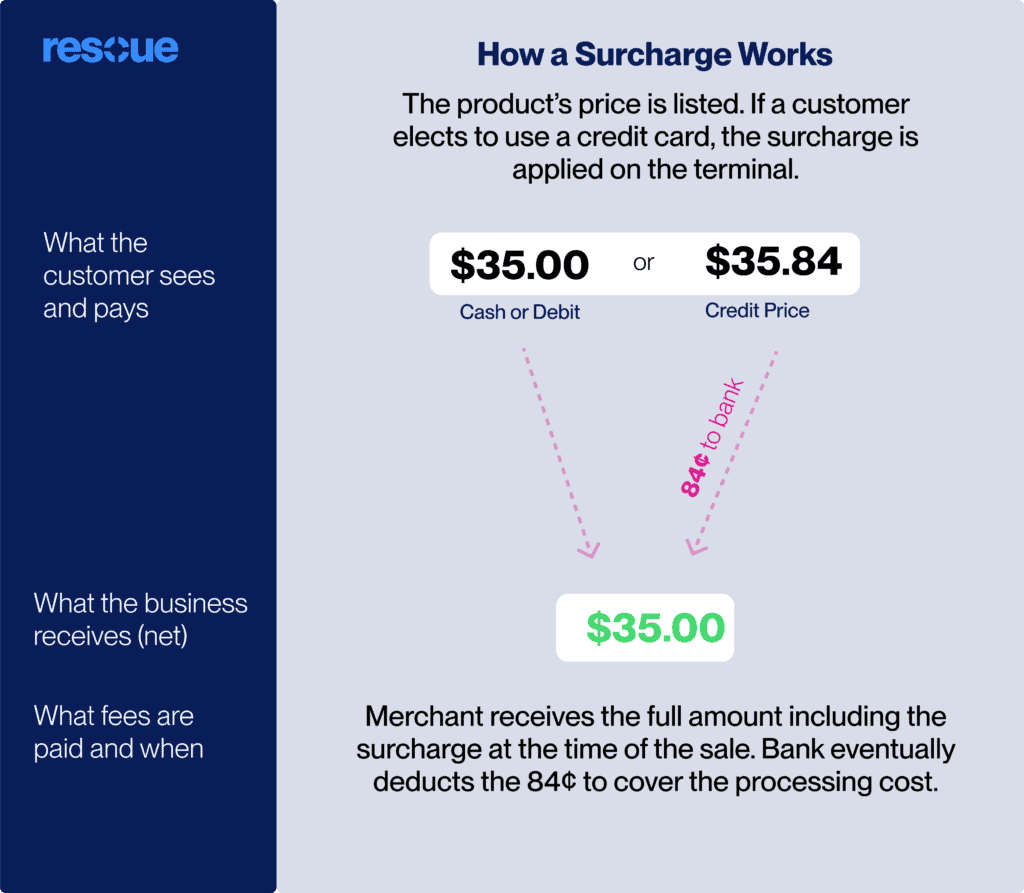

Let’s dive into what credit card surcharges are, understand their complexities and the potential role they play for your business. At its core, a credit card surcharge is an additional fee that merchants can opt to charge customers who choose to pay with a credit card. This fee is a percentage of the purchase price (2.4%) and is intended to help merchants offset the cost associated with processing credit card transactions. It’s more than just an extra charge; it’s a strategic business decision with implications for customer experience and your bottom line.

To give a visual, here is how a surcharge works from a financial perspective.

Why This Matters to Canadian Merchants and Business Owners

For small business owners in Canada, understanding and potentially implementing credit card surcharges an important consideration for any company that accepts credit cards. Why? Because each swipe, tap, or insert of a credit card in your store or online platform incurs processing fees. These fees can nibble away at your profits, especially if your business experiences a high volume of credit card transactions. In a market where margins can be tight, knowing how to manage these costs effectively is vital.

Navigating the Regulations and Networks

It’s not just about deciding to add a surcharge; it’s also about doing it right. Credit card networks like Visa, Mastercard, and others have specific rules and regulations regarding surcharging. Additionally, Canadian laws and regulations add another layer of complexity to this scenario. This guide will provide clarity on these regulations, helping you navigate the legalities and practicalities of implementing surcharges.

Preview of What’s Ahead

As a bit of background, let’s explore various facets of credit card surcharges. You’ll learn about dual pricing strategies, where different prices are set for cash and credit card payments. We’ll examine real-world examples of how businesses successfully manage surcharges, insights into consumer reactions, and tips on balancing additional revenue against customer satisfaction. Plus, we’ll explore the specifics of card network policies, dissecting the fine print so you can make informed decisions about surcharging in your business.

By the end of this guide, you’ll not only grasp the concept of credit card surcharges but also understand how to apply this knowledge effectively in your business, ensuring compliance, customer satisfaction, and financial health.

What is a Credit Card Surcharge?

Credit Card Surcharge 101

Simply put, a credit card surcharge is an extra fee that a business adds to a customer’s bill when they opt to pay with a credit card. Think of it as a small percentage of the total transaction amount. This surcharge is primarily designed to help merchants offset the costs incurred from processing credit card payments. Each swipe or tap of a credit card in your store incurs fees charged by credit card companies, and the surcharge is a way for businesses to recover these expenses.

Understanding Convenience Fees

Closely related yet distinct, convenience fees are charged for the privilege of using an alternative payment method or channel which is not standard for the business. For example, a convenience fee might be added for phone or online payments if the usual business practice is in-person transactions. This fee is not directly tied to the use of a credit card but rather the payment channel’s convenience.

Distinguishing A Credit Card Surcharge from a Processing Fee

It’s crucial to differentiate between surcharges and credit card processing fees. The latter are the fees charged by credit card companies to process transactions, a cost of doing business for merchants accepting credit card payments. Surcharges, on the other hand, are the fees that merchants choose to pass on to customers to cover these processing costs.

In essence, while credit card processing fees are a non-negotiable cost incurred by the merchant, surcharges represent a choice—a way for businesses to balance the scales. They are a reflection of a merchant’s policy on handling the cost of credit card transactions, not just a mere addition to the price.

In the next sections, we’ll delve deeper into the implications of implementing these surcharges, how they affect both the business and the customer, and the legal and ethical considerations that come into play. Understanding these nuances is key to making informed decisions that align with your business goals and customer satisfaction.

The Legality of Credit Card Surcharges and Dual Pricing in Canada

When it comes to incorporating credit card surcharges into your business model, it’s not just a matter of decision and implementation. In Canada, the legal landscape around surcharging is as important as the surcharge itself. Let’s navigate through the intricacies of Canadian regulations and understand how they shape a small business owner’s approach to surcharges.

Navigating Canadian Regulations on Surcharges

In Canada, the legal framework governing credit card surcharges is multi-faceted. For years, there were restrictions on the ability of merchants to add surcharges to credit card transactions. However, recent developments have seen changes in these regulations, offering more flexibility to merchants. It’s crucial for business owners to stay abreast of these changes to ensure they remain compliant while considering surcharging.

For details on the GST/HST implications of surcharge, check out our guide.

Understanding Credit Card Network Rules

Apart from national regulations, credit card networks like Visa, Mastercard, and American Express have their own set of rules regarding surcharging. These rules often dictate the maximum surcharge that can be imposed, how it should be communicated to customers, and on which types of transactions it can be applied. Compliance with these network rules is vital to avoid penalties or revocation of the privilege to accept these cards.

Impact on Small Business Owners

For small business owners, these regulations and rules directly impact the decision to add or impose a surcharge. While surcharges can help offset the cost of credit card processing fees, ensuring that these charges are within legal and network guidelines is paramount.

- Legal Compliance: Small business owners must ensure their surcharge practices comply with Canadian laws and regulations. This includes understanding any provincial nuances that might exist.

- Transparent Communication: Both Canadian law and credit card network rules emphasize transparency. This means clearly disclosing any surcharges to customers before they make a payment.

- Balancing Costs and Customer Relations: Deciding to implement a surcharge also involves considering how it will affect customer relations. While it helps in offsetting costs, it could also influence consumer behavior. Balancing these aspects is a strategic decision that every merchant needs to make.

While the ability to add surcharges provides a tool for managing the costs of accepting credit cards, navigating the legal and regulatory landscape requires careful consideration. Canadian small business owners need to not only understand these laws and rules but also implement surcharges in a way that aligns with both legal compliance and their business strategy. In the upcoming sections, we will explore further how to tactically implement surcharges.

Why Implement a Credit Card Surcharge Program? Here are the key benefits for merchants.

Implementing a credit card surcharge program can be a strategic move for merchants, offering a range of benefits that extend beyond merely covering transactional costs. Let’s delve into the multifaceted advantages that such a program can bring to your business.

Financial Sustainability

Offsetting Transaction Costs

The most immediate benefit of implementing a surcharge is the direct offset of credit card transaction fees. For many businesses, especially those with lower profit margins, these fees can represent a significant financial strain. Surcharges provide a straightforward way to recuperate these costs, helping to maintain financial stability.

Improved Cash Flow: By recouping the costs associated with credit card transactions, businesses can see an improvement in their overall cash flow. This financial relief can be particularly crucial for small businesses or those in highly competitive markets, where every dollar counts.

Strategic Pricing

More Accurate Pricing Strategy: Implementing a surcharge allows businesses to more accurately reflect the true cost of their goods or services. Without surcharges, businesses often have to incorporate credit card fees into their pricing, which can lead to slightly higher prices across the board. Surcharges enable a more transparent pricing strategy, where customers using credit cards understand they are paying for the convenience.

Competitive Pricing for Cash Transactions: For businesses that offer both cash and credit payment options, surcharges can enable more competitive pricing for cash transactions. This can be an attractive option for cost-conscious customers, potentially driving more cash-based sales.

Enhancing Business Operations

Encouraging Efficient Payment Methods: Surcharges can subtly encourage customers to use more cost-effective payment methods. This can lead to a higher volume of transactions using methods like debit cards or cash, which typically incur lower processing fees than credit cards.

Investment in Business Growth: The savings garnered from surcharges can be reinvested into the business, aiding in growth and expansion. This could translate into better infrastructure, more staff, enhanced training, or expanded product lines.

Customer Relations and Market Perception

Transparent Cost-Sharing: When implemented thoughtfully, surcharges can foster a sense of partnership between the business and its customers. By transparently sharing the costs of credit card processing, customers can feel more involved and supportive of the business, especially if they understand how these fees impact small businesses.

Adaptability in a Changing Market: As the market and consumer behaviors evolve, especially with the increasing use of credit cards, surcharges offer a way for businesses to adapt financially. This adaptability is crucial for staying relevant and competitive in a rapidly changing economic landscape.

In conclusion, implementing a credit card surcharge program offers a spectrum of benefits for merchants, from direct financial advantages to strategic operational improvements. It’s a tool that, when used judiciously, can enhance both the fiscal health of a business and its relationship with customers. The key is to approach surcharging with a mindset that prioritizes transparency, fairness, and strategic planning.

How to Implement a Credit Card Surcharge Program

Implementing a credit card surcharge program is a strategic move that requires careful planning and execution when accepting credit cards in Canada. For small business owners, the key lies in understanding the steps involved and ensuring compliance with major credit card networks like Visa and Mastercard. Here’s a step-by-step guide to help you navigate through this process with clarity and confidence.

Step 1: Understand the Rules and Regulations

Research Your Legal Obligations: Before anything else, familiarize yourself with both the federal and provincial regulations in Canada regarding credit card surcharges. This understanding is crucial to ensure that your surcharge program is legally compliant. Rescue handles all of this for you.

Review Credit Card Network Guidelines: Each credit card network, such as Visa and Mastercard, has specific rules regarding surcharging. These guidelines often cover aspects like the maximum permissible surcharge, disclosure requirements, and types of transactions where surcharges are allowed. It’s imperative to review these guidelines in detail to ensure full compliance.

Step 2: Communicate with Your Customers

Transparent Disclosure: Once you decide to implement a surcharge, inform your customers about it in advance. Transparency is key – clearly explain why the surcharge is being introduced and how it will be applied.

Signage and Receipts: Use clear signage at the point of sale and online, if applicable, to inform customers about the surcharge. Also, ensure that the surcharge is itemized on receipts, so customers know exactly what they are paying for. There are legal requirements for getting this right and Rescue can help set this up for you.

Step 3: Train Your Staff

Staff Awareness and Training: Your staff should be well-informed about the surcharge policy to answer any customer queries confidently. Training sessions can help ensure that all team members understand the rationale behind the surcharge and how to communicate it effectively to customers.

Step 4: Stay Compliant

Regular Review of Policies and Regulations: The rules surrounding credit card surcharges can evolve. Regularly review your policies and stay informed about any changes in legal and credit card network regulations to ensure ongoing compliance and clearly disclose surcharges and fees.

Implementing a credit card surcharge program is not just about adding an extra fee; it’s about doing so in a manner that is fair, transparent, and compliant with regulations. This approach not only helps in covering the costs associated with credit card transactions but also maintains the trust and loyalty of your customers. By following these steps, you can implement a surcharge program that supports your business’s financial health while respecting your customers’ experience.

FAQ: Navigating Credit Card Surcharge Programs in Canada in 2024

Here are some common questions and their answers to help clarify regulations, implementation, and customer impact in the Canadian context.

1. What is a credit card surcharge?

Answer: A credit card surcharge is an additional fee that a business charges customers who choose to pay with a credit card. It’s designed to cover the cost of processing credit card transactions.

2. Is it legal to implement a credit card surcharge program in Canada?

Answer: Yes, it is legal in Canada to implement a credit card surcharge program, but businesses must adhere to specific regulations and guidelines set by credit card networks and Canadian law.

3. Do all credit card companies allow surcharges?

Answer: Major credit card companies like Visa and Mastercard permit surcharges, but they have specific rules and conditions that businesses must follow.

4. How much can I charge for a credit card surcharge?

Answer: The surcharge amount typically reflects the cost of processing credit card transactions. It’s important to set a rate that covers these costs without being excessive.

5. Are there any caps on surcharge amounts?

Answer: Yes, credit card networks usually have a cap on surcharge amounts. These caps are often a percentage of the transaction value.

6. Can surcharges be applied to both credit and debit card transactions?

Answer: Surcharges are generally applied to credit card transactions only. Applying surcharges to debit card transactions may not be permissible under certain network rules and regulations.

7. How should I inform customers about the surcharge?

Answer: Transparency is key. Customers should be informed about surcharges through clear signage at the point of sale and detailed information on receipts.

8. Do I need to notify credit card networks before implementing a surcharge?

Answer: Yes, most credit card networks require merchants to notify them before implementing a surcharge program.

9. Can I impose a surcharge on all types of credit card transactions?

Answer: This depends on the rules of the specific credit card network. Some transactions, like those with certain premium cards, may have different rules.

10. Will implementing a surcharge impact my sales?

Answer: It might, as some customers may prefer other payment methods to avoid the surcharge. It’s important to monitor customer reactions and adjust your strategy accordingly.

11. How do I calculate the surcharge amount?

Answer: The surcharge is typically calculated as a percentage of the transaction amount, based on your average cost of processing credit card payments.

12. Can surcharges vary based on the type of credit card used?

Answer: Yes, surcharges can vary depending on the card type, as different cards have different processing fees. However, this must be clearly communicated to customers.

13. How do surcharges affect customer perception?

Answer: If not implemented carefully, surcharges can negatively impact customer perception. Clear communication and justification for the surcharge are essential to maintain customer trust.

14. Are there alternatives to surcharging customers?

Answer: Yes, some businesses choose to increase product or service prices slightly across the board to cover credit card processing fees instead of implementing a surcharge.

15. Can I offer discounts for non-credit card payments?

Answer: Offering discounts for alternative payment methods like cash or debit is a common strategy to encourage customers to use these methods.

16. What happens if a customer disputes a surcharge?

Answer: If a customer disputes a surcharge, it should be handled like any other customer service issue, with clear communication and a focus on resolution. This includes merchant discounts.

17. How often should I review my surcharge policy?

Answer: Regularly reviewing your surcharge policy is important to ensure it remains compliant with regulations and effective for your business needs.

18. Are there any tax implications for surcharge fees?

Answer: Yes, surcharge fees are subject to the same tax implications as the goods or services being sold. It’s important to include them in your tax calculations.

19. Can I implement a surcharge for online transactions?

Answer: Yes, surcharges can be applied to online transactions, but the same rules of transparency and network compliance apply.

20. What should I do if credit card network rules change?

Answer: Stay informed about changes in credit card network rules and adjust your surcharge policy accordingly to remain compliant.

This FAQ aims to provide clarity and guidance on the various aspects of credit card surcharge programs, helping Canadian small business owners make informed decisions and implement effective strategies.